Reddit’s (RDDT) more-than-10% owner, Tencent Holdings (TCEHY), has significantly reduced its stake in the company by $197.6 million. This comes after RDDT’s Director Michael Seibel sold shares worth nearly $9.1 million on November 1. Perhaps Reddit’s insiders are taking advantage of the significant 137.4% surge in its share price over the past three months.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Reddit is a social media platform and online community where users share, discuss, and vote on content across several topics.

Closer Look at the Insider’s Move

According to the SEC filing, Tencent sold 1,498,403 shares of Reddit between November 11 and November 12, at an average price of $131.86 per share. It should be noted that the shares were sold by Tencent Cloud Europe B.V., a wholly-owned subsidiary of Tencent. Following the latest transaction, Tencent Cloud Europe B.V. now holds 9,238,594 shares of Reddit’s Class A common stock.

Bearish Insider Sentiment for RDDT Stock

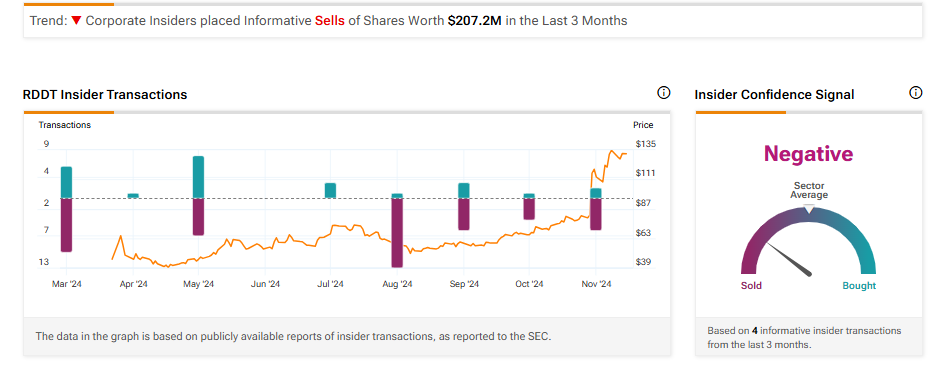

In addition to the two insiders mentioned above, several other corporate insiders at Reddit have reduced their stake in the company. Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in RDDT stock is Negative. Corporate insiders have sold the company’s shares worth $207.2 million over the last three months.

Investors could keep close track of these notable insider activities, as they reflect the perceptions of key insiders about the company’s prospects. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is RDDT a Buy or Hold?

Turning to Wall Street, RDDT stock has a Moderate Buy consensus rating based on 10 Buys, five Holds, and one Sell assigned in the last three months. At $104.69, the average Reddit price target implies a 20.62% downside potential.