Hewlett Packard Enterprise’s (HPE) President and CEO, Antonio Neri, sold stock worth $1.6 million last week. This stock sale was part of a 10b5-1 trading plan, adopted on June 14, 2024. It is worth mentioning that the trading plan allows insiders to sell a specified number of shares at a predetermined time, providing a legal defense against insider trading accusations.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

HPE is a global technology company providing enterprise IT solutions, including cloud services, servers, and data storage systems.

Closer Look at the Insider’s Trades

According to the filing, on September 25, Neri sold shares priced between $19.58 and $19.84 each. Investors should note that prior to the latest sale, Neri sold HPE stock worth $3.08 million on September 18.

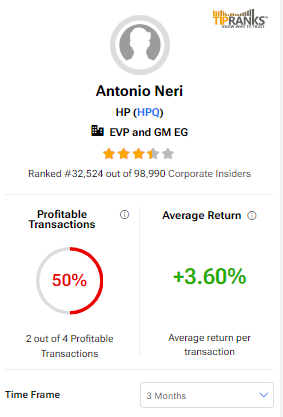

Importantly, Neri still owns around 1.76 million shares of HPE stock, worth about $35.4 million. Moreover, Neri’s trading track record seems decent. According to the data collected by TipRanks, the insider has had a success rate of 50% over the past year, with an average return of 3.6% per transaction.

Insiders Sentiment for HPE Stock Is Currently Negative

Just like the CEO’s recent sale, corporate insiders have sold the company’s shares worth $4.7 million over the last three months. Overall, the sentiment among corporate insiders is currently Negative.

Investors may benefit from keeping an eye on transactions made by key insiders, as these trades typically reflect their trust in the company’s future. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is HPE Stock a Good Buy?

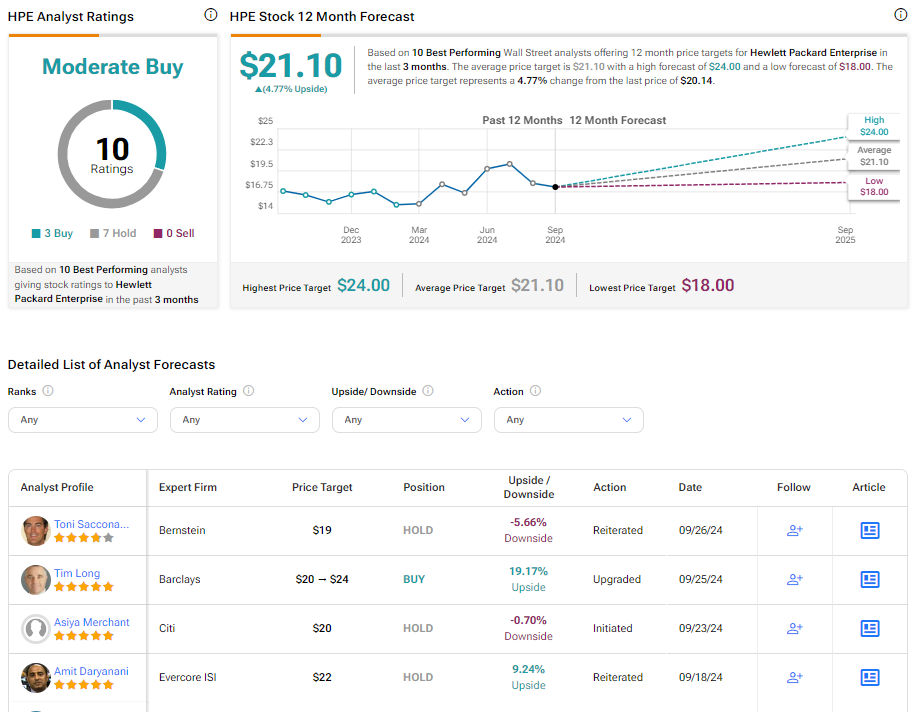

Turning to Wall Street, HPE stock has a Moderate Buy consensus rating based on three Buys and seven Holds assigned in the last three months. At $21.10, the average Hewlett Packard Enterprise price target implies a 4.77% upside potential. Shares of the company have gained 13.79% in the past six months.