One of BioLife Solutions’ (NASDAQ:BLFS) more than 10% owners, Casdin Partners Master Fund, L.P., recently undertook a buy transaction worth $10.4 million. BLFS stock gained about 9% in Monday’s after-market hours following the disclosure of the key insider’s trade.

BioLife Solutions is a leading developer and supplier of biopreservation tools and services for cells, tissues, and organs in regenerative medicine and drug discovery.

As per the SEC filing, Casdin Partners Master Fund bought 927,165 shares of the company at a weighted average price of $11.19 per share on October 19. The total value of BLFS stock in the firm’s portfolio currently stands at $88.8 million.

Recent Developments

The purchase comes at a time when BLFS announced the appointment of Roderick de Greef as the new Chairman and CEO last week. Greef succeeded Michael Rice, who served the company for 17 years. Also, the company updated its full-year guidance and now expects revenue to be at the lower end of the $144 million to $158 million guidance range.

The company explained that its updated outlook reflects “near-term trends in the business based on this macro backdrop and recent customer interactions.”

It is worth mentioning that following the new CEO appointment and outlook update, TD Cowen analyst Steven Mah and two other analysts rated the stock a Buy.

Bullish Insider Confidence Signal

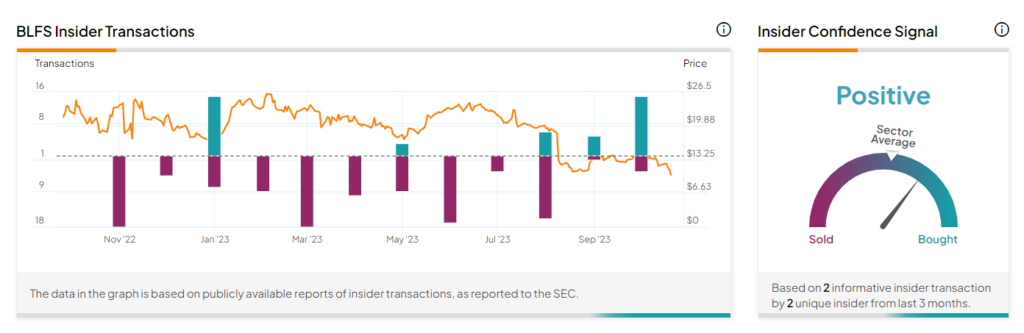

Overall, corporate insiders have bought BioLife Solutions stock worth $11.1 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in BLFS is currently Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

What is the Price Target for BLFS?

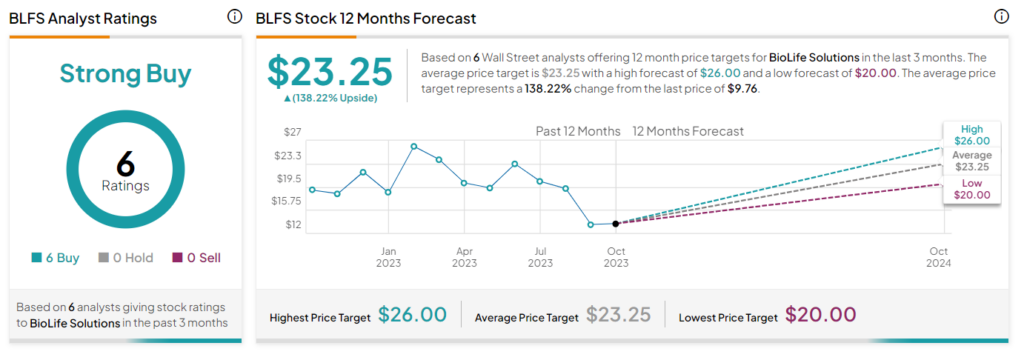

Currently, BLFS stock’s average price target of $23.25 implies an upside potential of 138.22% from the current level. Furthermore, BioLife Solutions has a Strong Buy consensus rating based on six unanimous Buys.

Discover the insider trading tool driving results for investors