Minnesota-based UnitedHealth Group (UNH) serves the healthcare system, operating through the UnitedHealthcare and Optum brands. Through its UnitedHealthcare unit, the group provides healthcare coverage and health-benefit services. It offers technology-powered health services through its Optum brand.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, UnitedHealth reported revenue of $73.7 billion, which rose from $65.5 billion in the same quarter the previous year and exceeded the consensus estimate of $72.7 billion. It posted adjusted EPS of $4.48, which jumped from $2.52 in the same quarter the previous year and beat the consensus estimate of $4.31.

UnitedHealth plans to distribute a quarterly dividend of $1.45 per share on March 22. It has set March 13 as the ex-dividend date.

With this in mind, we used TipRanks to take a look at the risk factors for UnitedHealth.

Risk Factors

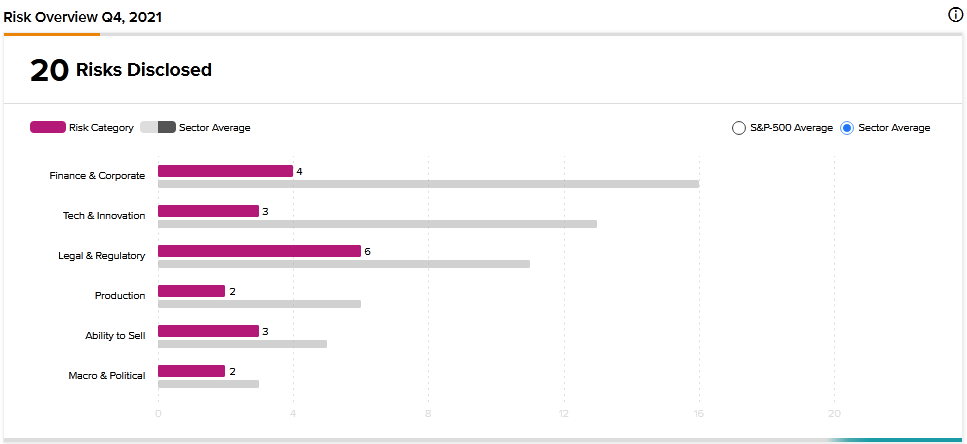

According to the new TipRanks Risk Factors tool, UnitedHealth’s top risk category is Legal and Regulatory, with 6 of the total 20 risks identified for the stock. Tech and Innovation and Ability to Sell are the next two major risk categories, each with 3 risks. UnitedHealth has recently updated many of its risk factors to stress certain challenges it faces.

In an updated Legal and Regulatory risk factor, UnitedHealth tells investors that the nature of its business means it is routinely subject to a variety of legal actions. For example, it mentions disputes with hospitals, physicians, and enrollees over payment claims. It also cites labor disputes and issues related to antitrust lawsuits and taxes. UnitedHealth cautions that dealing with the legal issues may cause its expenses to increase significantly, dealing a blow to its operating results and financial conditions. Moreover, certain legal actions could damage the company’s reputation and make it difficult to retain its current business or grow its market share.

In an updated Ability to Sell risk factor, UnitedHealth reminds investors that its business could suffer if it fails to maintain good relationships with its partners and customers. It explains that in some markets, hospitals and physicians could refuse to do business with it, seek higher payments, or take actions that could make it difficult to meet regulatory requirements. Furthermore, in some markets hospital organizations and physician groups may hold significant market positions that could diminish UnitedHealth’s bargaining power.

Analysts’ Take

In January, Leerink Partners analyst Whit Mayo maintained a Buy rating on UnitedHealth stock and raised the price target to $550 from $480. Mayo’s new price target suggests 14.57% upside potential. The analyst notes that fading COVID-19 and political risks bode well for the stock.

Consensus among analysts is a Strong Buy based on 18 Buys and 3 Holds. The average UnitedHealth price target of $527.71 implies 9.93% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Nvidia’s Record Q4 Revenue and Earnings Beat Estimates, Issues Guidance

APTS Rises 10.8% on $5.8B Takeover Deal with Blackstone

BioNTech to Ramp Up Vaccine Production in Africa