Massachusetts-based Thermo Fisher (TMO) describes itself as a global leader in serving science. The company supplies instruments, reagents, and other consumables for scientific research, diagnostics, and analysis.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Thermo Fisher recently inked a 15-year collaboration agreement with Moderna (MRNA). The strategic deal is focused on enabling large-scale U.S. manufacturing of Moderna’s Spikevax COVID-19 vaccine and other products.

For Q4 2021, Thermo Fisher reported a 1% year-over-year rise in revenue to $10.7 billion and surpassed the consensus estimate of $8.8 billion. It posted adjusted EPS of $6.54, which declined from $7.09 in the same quarter the previous year but still beat the consensus estimate of $4.93.

The company plans to distribute a quarterly dividend of $0.30 per share, reflecting a 15% boost over the previous dividend payment. It plans to distribute the improved dividend on April 14 to shareholders of record on March 16.

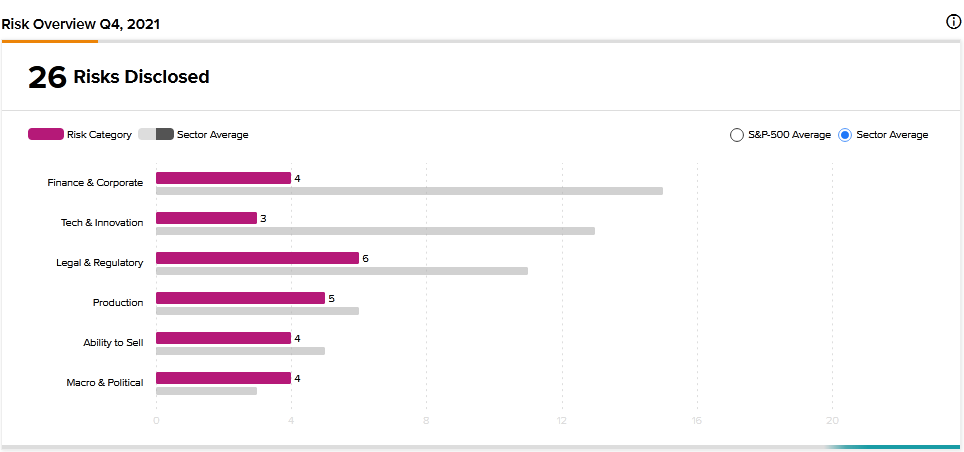

With this in mind, we used TipRanks to take a look at the newly added risk factors for Thermo Fisher.

Risk Factors

According to the new TipRanks Risk Factors tool, Thermo Fisher’s top risk category is Legal and Regulatory, with 6 of the total 26 risks identified for the stock. Production and Finance and Corporate are the next two major risk categories with 5 and 4 risks, respectively. The company recently added three new risk factors.

Thermo Fisher recently acquired clinical research services provider PPD for $17.4 billion. It hopes the acquisition will enable it to achieve $125 million in synergies by the third year following the closing of the transaction. In a newly added Finance and Corporate risk factor, Thermo Fisher cautions that those benefits may not be achieved or may take longer than anticipated to achieve.

It explains that the integration process is difficult and costly and could adversely affect Thermo Fisher’s relationship with employees, customers, and suppliers. It further warns that a loss of key employees could adversely affect its ability to conduct business in PPD’s market, which may adversely impact Thermo Fisher’s financial results.

In a newly added Production risk factor, Thermo Fisher tells investors that the success of its business largely depends on its ability to retain a qualified workforce. But it cautions that qualified workers are in high demand and it may incur significant costs to attract and retain them. The company explains that management changes and poaching by competitors are some of the factors that could make attracting and retaining key talent difficult. Thermo Fisher cautions that a loss of personnel may have a material adverse impact on its operating results and financial condition.

In a newly added Legal and Regulatory risk factor, Thermo Fisher discusses the tightening environmental, social, and governance (ESG) requirements. It explains that stakeholders are increasingly focusing on companies’ ESG practices. At the same time, government authorities are enhancing regulatory requirements relating to ESG matters. Thermo Fisher warns that failure to meet its ESG expectations may result in the loss of business, an inability to retain top talent, and a reduced stock price. Additionally, the company cautions that it may suffer reputational harm.

Analysts’ Take

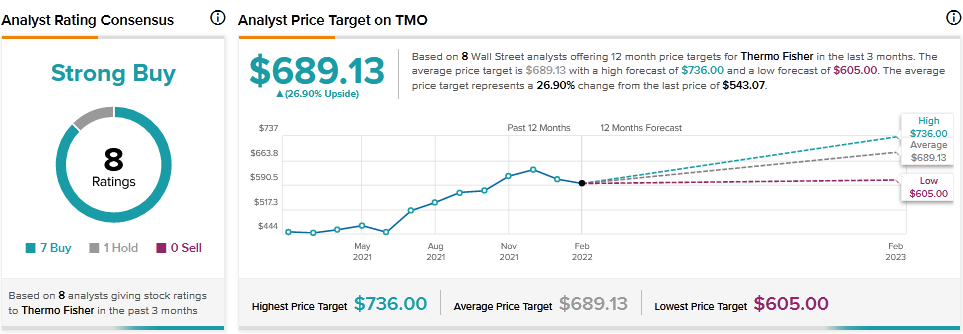

Cowen & Co. analyst Daniel Brennan recently reiterated a Buy rating on Thermo Fisher Scientific stock and raised the price target to $736 from $715. Brennan’s new price target suggests 35.53% upside.

Consensus among analysts is a Strong Buy based on 7 Buys and 1 Hold. The average Thermo Fisher price target of $689.13 implies 26.90% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Horizon Therapeutics Delivers Upbeat Results in Q4; Shares Up 6.5%

AMC Entertainment Books Smaller-than-Feared Q4 Loss

Target Gains 10% on Outstanding Q4 Results & Positive Outlook