U.K.-based Nomad Foods (NOMD) is a multinational frozen food company. It sells its products under brands such as Ledo, Frikom, Findus, Iglo, and Birds Eye.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, Nomad reported a 7% year-over-year jump in revenue to 704 million euros. It posted adjusted EPS of 0.33 euros. The company ended the quarter with 254.2 million euros in cash.

In an expansion move, Nomad acquired Fortenova Group’s frozen food business for about 615 million euros to add brands with leading market share in countries like Croatia, Hungary, Serbia, Slovenia, and Kosovo.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Nomad Foods.

Risk Factors

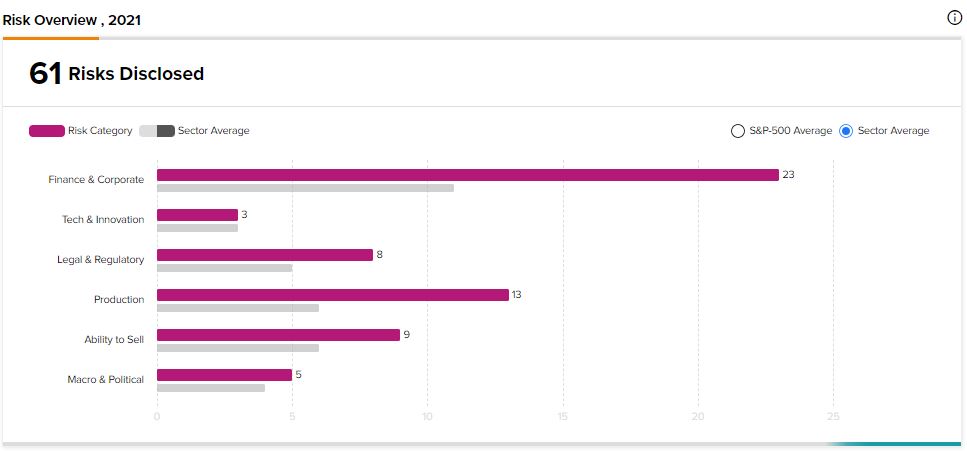

According to the new TipRanks Risk Factors tool, Nomad Foods’ main risk category is Finance and Corporate, with 23 of the total 61 risks identified for the stock. Production and the Ability to Sell are the next two major risk categories with 13 and 9 risks, respectively. The company recently updated its profile with eight new risk factors, and here are the takeaways.

Nomad Foods informs investors that if it pays dividends or repurchases its shares, its cash flow may be adversely impacted,and it could experience challenges servicing its debts. While the company says it currently has no plans to pay dividends, it says the board may authorize a repurchase program.

The company tells investors that the Fortenova acquisition adds a new product category and takes it to new market geographies in which it lacks previous experience. It explains that consumer preferences and buying habits in Fortenova’s markets may differ significantly from its current markets. As a result, Nomad Foods cautions that it may be unable to successfully replicate the advertising strategies used in its existing business in Fortenova’s markets. The company goes on to say that failure to achieve the anticipated benefits of the Fortenova acquisition could adversely affect its operating results and financial condition.

Finally, Nomad Foods says that its ability to achieve its sustainability targets is subject to factors outside its control. The company cautions that failure to meet its sustainability goals could impact the demand for its products and adversely affect its business, financial condition, and operating results.

Analysts’ Take

Deutsche Bank analyst Stephen Powers recently reiterated a Buy rating on Nomad Foods stock but lowered the price target to $30 from $33. Powers’ reduced price target still suggests 47.64% upside potential.

Consensus among analysts is a Strong Buy based on 5 Buys. The average Nomad Foods price target of $30.60 implies 50.59% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Bill.com and CPA.com Extend Partnership; Street Says Buy

Amazon Plans to Reinvent Radio with Live Audio App Amp

Ford Partners with Verisk to Offer Car Insurance Data in Europe