Bank of America (BAC) is a multinational banking and financial services company. Based in North Carolina, Bank of America was founded in 1904.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, the bank reported a 10% year-over-year increase in revenue to $22.1 billion but slightly missed the consensus estimate of $22.2 billion. It posted adjusted EPS of $0.82, which rose from $0.59 in the same quarter the previous year and beat the consensus estimate of $0.76.

The bank plans to distribute a quarterly dividend of $0.21 per share on March 25 and has set March 3 as the ex-dividend date. The stock currently offers a dividend yield of 1.75%, compared to the sector average of 1.68%.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Bank of America.

Risk Factors

According to the new TipRanks Risk Factors tool, Bank of America’s main risk category is Finance and Corporate, with 15 out of the total 40 risks identified for the stock. Macro and Political and Legal and Regulatory are the next two major risk categories with 11 and 7 risks, respectively. The bank recently updated its profile with nine new risk factors.

The bank tells investors that its business and operating results may suffer from changes in fiscal and monetary policies. For example, it mentions that it may incur losses if interest rates changes lead to a decline in asset values. Furthermore, the company explains that adverse changes in capital market conditions may heighten its market risks.

Bank of America informs investors that a breach of its security systems could disrupt its critical business operations and adversely impact its financial condition. Moreover, such a breach could result in reputational damage to the company.

Noting that it is subject to extensive regulations, the bank cautions that it faces significant reputational and financial risks. It mentions that such risks stem from potential liability caused by regulatory actions and lawsuits. It explains that reputational damage could harm its competitiveness and business prospects. The company further cautions that it may be adversely impacted by changes to domestic and international tax laws.

Finally, the company warns that the COVID-19 pandemic may continue to adversely impact its business. It explains that the duration of the pandemic and its future impact are still uncertain.

Bank of America stock has gained about 46% over the past 12 months.

Analysts’ Take

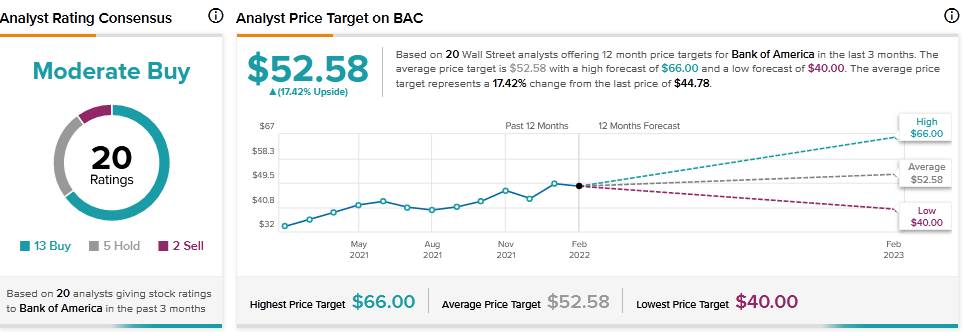

Jefferies analyst Ken Usdin recently reiterated a Hold rating on Bank of America stock with a price target of $50, which suggests 11.66% upside potential.

Consensus among analysts is a Moderate Buy based on 13 Buys, 5 Holds, and 2 Sells. The average Bank of America price target of $52.58 implies 17.42% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

SNC-Lavalin Enters Strategic Partnership with MBC Group

Scotiabank Launches Mentorship Program for Women Entrepreneurs

Bausch Health Swings to Profit in Q4