FTSE 100-listed Imperial Brands (GB:IMB) posted a jump in its operating profit for FY24, fueled by growth in its next-generation products (NGP) category, which includes vapes and nicotine pouches. Net revenue from the NGP category grew 26%, driven by regionally balanced growth and improved gross margin. As a result, NGP’s adjusted losses decreased 43% to £79 million. Following the results, IMB stock opened higher and gained over 2% at the time of writing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Imperial Brands is among the biggest tobacco manufacturing companies in the world, with well-known brands like West, Davidoff, Gauloises, and more.

IMB’s Shift to Next-Gen Products Drives Profit Growth

Imperial Brands reported a year-over-year growth of 4.6% in its adjusted operating profit, reaching £3.91 billion on constant currency. Meanwhile, its total revenue reached £32.41 billion, marking a slight decline of 0.2% compared to the previous year.

In the NGP category, Imperial Brands continues to expand its presence through partnerships and product innovation across all three categories: Vapour, Heated tobacco, and Oral nicotine. In FY24, the company achieved market share growth across all three NGP categories, with NGP net revenue now accounting for approximately 8% of its tobacco business.

On the other hand, tobacco volumes fell 4% during the year as smoking rates declined around the Western world.

Regarding shareholder returns, the company has allocated £1.25 billion for share buyback in FY25, reflecting a 13.6% increase compared to FY24. Additionally, the FY24 dividend per share increased by 4.5% to 153.42p, in line with the company’s progressive dividend policy.

IMB Confirms FY25 Guidance

Moving forward, Imperial Brands announced that it is developing a new five-year strategy through 2030 and confirmed its FY25 guidance. The company expects low single-digit growth in net revenue for both tobacco and NGP. Moreover, it expects the overall adjusted operating profit at constant currency to be close to the middle of the mid-single-digit range.

Are Imperial Brands Shares a Good Buy?

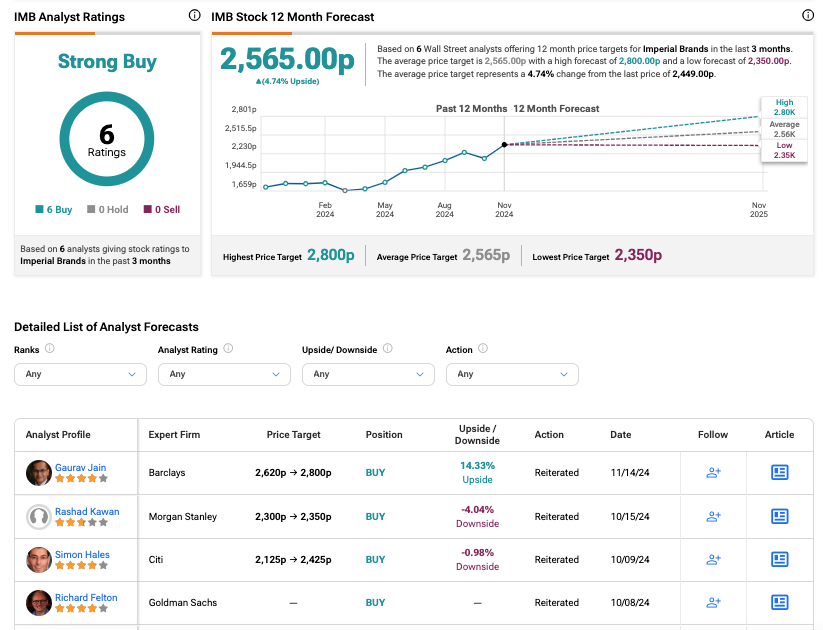

According to TipRanks’ consensus, IMB stock has received a Strong Buy rating based on unanimous Buy recommendations from six analysts. The Imperial Brands share price target is 2,565p, reflecting a 5% increase from the current trading level.