Hong Kong-listed BYD Co. Limited’s (HK:1211) shares dropped by 3.35% today after the Chinese automaker reported weak sales for its pure EVs (electric vehicles) for July 2024. The company’s July EV sales declined by 10% as compared to June, reaching 130,000 units. Nonetheless, BYD sold 342,383 NEVs (new energy vehicles) in July, marking a 30.6% year-over-year growth and surpassing its previous record of 341,658 in June.

Based in China, BYD Co. is one of the leading manufacturers of EVs in the world.

How Are BYD’s Competitors Performing?

BYD’s competitors NIO Inc. (HK:9866) and Li Auto, Inc. (HK:2015) also reported their July numbers.

Li Auto recorded sales of 51,000 cars in July, marking the second time it surpassed the 50,000 monthly deliveries mark after December 2023. The July sales figure represents 49.41% year-over-year growth and a 6.75% rise from 47,774 vehicles in June. Li Auto’s sales were driven by the demand for its Li L6 SUV, which crossed 20,000 units for the second month in a row.

Meanwhile, Nio sold 20,498 vehicles in July, down 3.35% month-over-month but up 0.18% from July 2023. Previously, Nio had achieved a substantial year-over-year growth of 98.1% by selling 21,209 units in June.

Overall, Chinese automakers achieved new delivery records in July, which is typically a slow period for auto sales. This followed the strong momentum in June and is expected to further solidify amid the intense competition in China’s EV market.

BYD’s July Sales Breakdown

In July, BYD’s plug-in hybrid electric vehicle (PHEV) sales continued their upward trend, marking the fifth consecutive month of growth. Sales surged by 66.87% year-over-year and 8% from June, reaching 210,799 units.

In the first seven months of 2024, BYD’s PHEV sales crossed the 1 million units mark and grew 44% over last year. During the same period, the company’s fully electric vehicle sales grew by 14% year-over-year, despite the slowdown in July.

Is BYD a Good Stock to Buy Now?

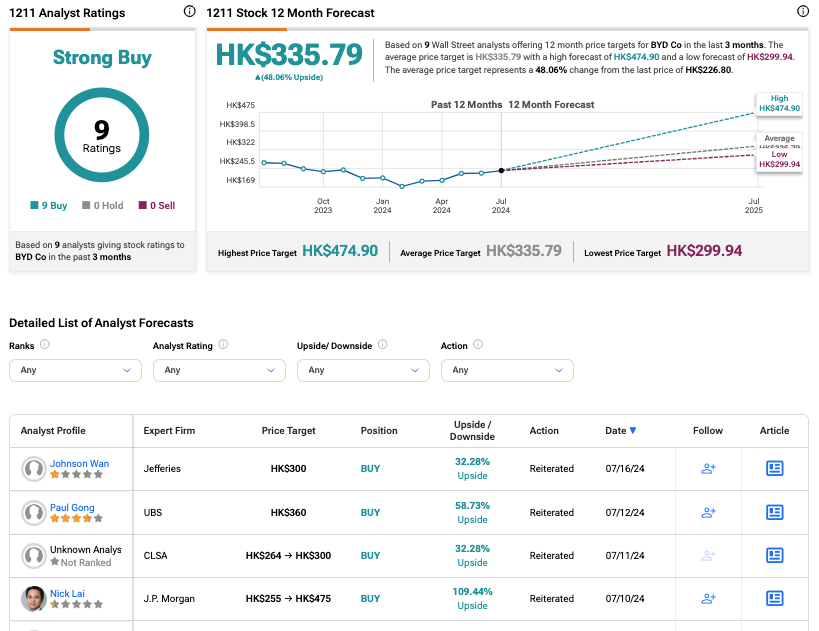

According to TipRanks, 1211 stock has received a Strong Buy rating, backed by nine Buy recommendations. The BYD Co. share price target is HK$335.79, which implies an upside of 48.06% from the current trading level.

Year-to-date, BYD shares have gained 4.7%.