French energy firm TotalEnergies SE (NYSE: TTE) and Honeywell International, Inc. (NASDAQ: HON) have signed an agreement to promote the development of advanced plastic recycling.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As per the terms of the agreement, Honeywell will use its UpCycle Process Technology to supply Recycled Polymer Feedstock (RPF) to TotalEnergies. TTE will convert this raw material into virgin-quality polymers for use in high demanding applications like food-grade packaging.

Honeywell will use the UpCycle Process Technology to make RPF at its soon-to-be-built advanced recycling plant in Andalucía, Spain. The North Carolina-based company plans to build the plant in a joint venture with Spanish infrastructure operator and developer Sacyr (SYRVF).

The Andalucía plant, which is expected to commence operations in 2023, is planned to process and convert 30,000 tons of mixed plastic waste into RFP every year. TotalEnergies will use this RPF to manufacture high-quality polymers at its production units in Europe.

Valérie Goff, the Senior Vice-President of Polymers at TotalEnergies, said, “This project, with a 2023 targeted startup, will contribute to meet our ambition of producing 30% recycled and renewable polymers by 2030.”

The Vice-President and General Manager of Honeywell Sustainable Technology Solutions, Ben Owens, said, “The relationship with TotalEnergies will provide a strong recycled polymer feedstock offtake partner and coupled with our recently announced advanced recycling plant with Sacyr, Honeywell is leading the drive toward a more circular plastics economy.”

About Honeywell

Multinational conglomerate Honeywell offers industry-specific solutions that include aerospace products and services; control technologies for buildings and industry; and performance materials.

HON stock closed 2.4% down on Thursday at $184.59.

Wall Street’s Take

After the company announced its fourth-quarter results, UBS (NYSE: UBS) analyst Markus Mittermaier maintained a Buy rating on the stock but lowered the price target to $220 from $237 (19.2% upside potential).

The analyst said, “Even (after) accounting for headwinds from lower mask sales, difficult Intelligrated comps, and a sluggish Defense business, investors were surprised by this subdued outlook, given the improving trends in commercial aerospace, non-residential spending, and double-digit orders growth in process solutions projects.”

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 8 Holds. The average Honeywell International price target of $226.27 implies 22.6% upside potential. Shares have lost 15.7% over the past year.

Blogger Opinions

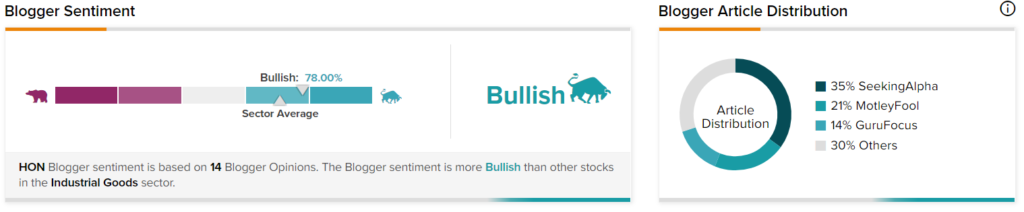

TipRanks data shows that financial blogger opinions are 78% Bullish on HON, compared to the sector average of 71%.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

BMO Enters Financing Agreement with Seaspan

Nutrien Hikes Dividend with Q4 Beat & Possible Buybacks of 10%

Aecom Updates 1 Key Risk Factor