Home improvement companies The Home Depot (HD) and Lowe’s (LOW) are two of the most compelling names in retail. A closer look using TipRanks’ Stock Comparison Tool shows a bullish outlook for each stock, as they share similar competitive moats, are well-managed, and are highly correlated.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Despite having reached maturity, I believe both stocks are likely to perform well over the next five to 10 years. However, considering valuations, shareholder returns, and the potential benefits of a lower interest rate environment, I believe Lowe’s is the better investment at this time.

HD vs. LOW: Key Differences

Before diving into my bullish thesis on Home Depot and Lowe’s, it’s important to highlight key differences in how these two businesses operate.

While both companies are fierce competitors in the home improvement space, they cater to slightly different segments of the market. Home Depot is more aligned with professional contractors and large-scale construction projects, offering a wider selection of heavy-duty tools and building materials at competitive prices. In contrast, Lowe’s tends to appeal more to homeowners and do-it-yourself (DIY) enthusiasts, with a stronger emphasis on home décor, customer experience, and design projects.

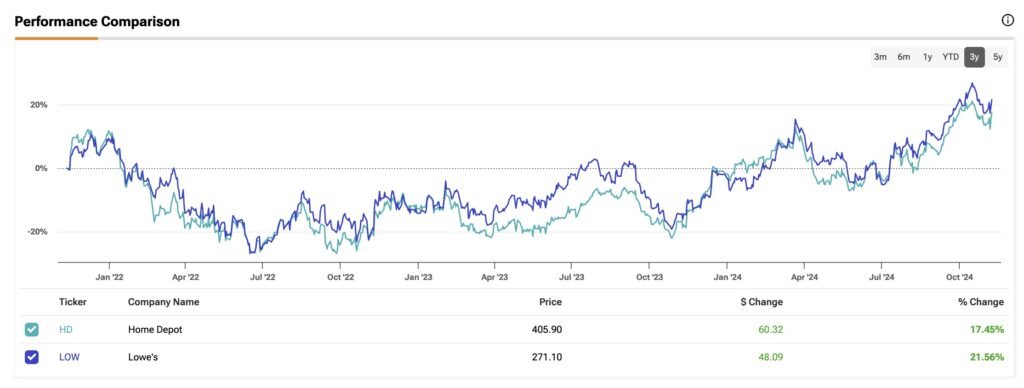

Both companies are vulnerable to economic conditions and the construction cycle, but Home Depot may fare better during periods of high interest rates due to its stronger position in commercial and professional sales. On the other hand, Lowe’s may face more headwinds from changes in consumer confidence and spending. As shown in the chart below, both companies have a high degree of correlation in their performance, with Home Depot trading at a five-year beta of 1.01 and Lowe’s at 1.10.

Moats and Shareholder Returns

One of the primary reasons to be bullish on Home Depot and Lowe’s is their strong competitive moats. Both are large-scale businesses with significant market power, extensive distribution networks, and strong supplier relationships. These advantages enable each company to achieve attractive metrics, such as high Return on Invested Capital (ROIC), along with solid cash generation that supports compelling shareholder returns.

For instance, Home Depot boasts an ROIC of 31.9% and a robust trailing operating margin of 15.1%, compared to Lowe’s with an ROIC above 30% and a slightly lower operating margin of 14.4%. In terms of cash flow generation, over the past 12 months, Home Depot has a cash flow margin of 13.4%, slightly outperforming Lowe’s at 11.4%, indicating a slight edge in operational efficiency for Home Depot.

These fundamentals also contribute to what investors in both companies care most about: returns to shareholders. Over the past 12 months, Home Depot distributed approximately $8.63 billion in dividends and repurchased $3.7 billion in shares, resulting in a dividend yield of 2.18% (with 14 consecutive years of dividend growth) and a buyback yield of less than 1%.

At the same time, Lowe’s distributed $2.53 billion in dividends and repurchased $3.71 billion in shares over the last 12 months. Lowe’s achieved a dividend yield of 1.66%, marking 61 years of dividend growth, and a buyback yield of 2.4%, making Lowe’s more generous in terms of share repurchases compared to Home Depot.

Growth and Valuations

Both Home Depot and Lowe’s have been mature companies for some time. As such, growth has been a less prominent factor in their bullish investment thesis. Starting with Home Depot, the company has grown its revenues at a compound annual growth rate (CAGR) of 6.7% over the last five years, but this growth has slowed to only 1.7% in the past three years. Lowe’s has experienced even slower growth, with a five-year revenue CAGR of 3.2% and a decline in revenues over the past three years at a CAGR of -3.88%.

The lackluster performance extends to the bottom line as well. Over the past three years, Home Depot’s net income has grown at a CAGR of -1%, while Lowe’s reported a similar decline, with a CAGR of -0.4% in net income.

When we turn to valuations, analysts project a modest decline in Home Depot’s earnings per share (EPS) of -0.8% and a slight revenue increase of 3% in 2025. Despite this, the stock currently trades at a forward price-to-earnings (P/E) ratio of 27x, which is nearly a quarter above its five-year historical average. Lowe’s faces even more pessimistic projections, with analysts expecting a 10.5% drop in EPS and a 4% decline in revenues during 2025. As a result, Lowe’s trades at a discounted forward P/E of 23x, though this is still about 30% above its historical average.

Upcoming Earnings

Despite my bullish outlook on LOW stock, I believe Home Depot has a better chance of outperforming Lowe’s with its third-quarter results. However, this doesn’t necessarily mean the market will favor one stock over the other. Last quarter, Home Depot reported a 3.3% decline in comparable sales, while Lowe’s experienced an even steeper drop of 5.1%, continuing a trend of declining sales over the past several quarters. This suggests a slowdown in consumer spending on home improvement projects.

For Q3, analysts expect Home Depot to report EPS of $3.64 (a 4% year-over-year decline) and revenues of $39.28 billion (a 4% year-over-year increase), with results to be announced on November 12. For Lowe’s, which will report on November 19, the consensus is EPS of $2.81 (an 8.3% year-over-year decline) and revenues of $19.91 billion (a 2.8% year-over-year decline).

Both companies have faced headwinds from inflation, rising interest rates, and a cooling housing market. However, Lowe’s appears to have been hit harder than Home Depot, with more pessimistic forecasts ahead. While interest rate cuts are likely to benefit Lowe’s more given its business model, the impact may become evident in more positive guidance in future quarters.

Is HD Stock a Buy?

On TipRanks, HD is rated as a Strong Buy by 26 Wall Street analysts, with 22 analysts giving it a Buy recommendation and four analysts assigning a Neutral rating. The average price target is $425.96, implying upside potential of nearly 5%.

Is LOW Stock a Buy?

Alternatively, LOW is rated a Moderate Buy by 24 analysts, with 16 analysts offering a Bullish recommendation and eight analysts giving a Neutral rating. The average price target for Lowe’s is $282.04, suggesting upside potential of about 4%.

Conclusion

I rate both Home Depot and Lowe’s stocks as long-term Buys given their strong competitive moats. While both companies have a similar slow-growth profile, and estimates point to a continuing contraction in the home improvement sector, I believe that a strong macro-economic environment that includes interest rate cuts and stronger consumer spending will favor Lowe’s stock slightly more than Home Depot, given its focus on homeowners rather than professional contractors. Therefore, by a small margin, I consider Lowe’s the better investment right now.