Shares of Teva Pharmaceuticals (NYSE:TEVA) fell 1.5% initially in extended trading hours and then rose yesterday on news of a court settlement. The Israel-based drugmaker agreed to pay $225 million to settle criminal charges over a drug price-fixing conspiracy in a 2020 trial. The fine will be paid in four equal installments of $22.5 million each over the course of five years, from 2024 to 2027. The remaining $135 million will be paid in 2028. This would be one of the largest fines ever paid by a drugmaker for antitrust crimes in the U.S.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Moreover, the court has required Teva’s U.S. subsidiary to divest its entire product line for pravastatin, a generic cholesterol drug. Plus, Teva will need to donate $50 million worth of other generic drugs to organizations treating needy patients, only under the supervision of the court.

Other Details of the Conspiracy and Settlement

The brighter side of the settlement is that Teva has entered into a deferred prosecution agreement (DPA) with the U.S. Department of Justice (DOJ). The DPA will aid Teva in avoiding “mandatory exclusion from participation in U.S. federal health care programs.” Prosecutors alleged that Teva and four other drug makers conspired to keep the price of pravastatin high and not bid to supply a customer with the drug. These cases took place between 2013 and 2015. Only one employee of Teva was involved in these conspiracies during the said period and left in 2016.

The other drugmakers involved in the cases included India-based Glenmark Pharmaceuticals and three American drugmakers, namely, Apotex, Taro Pharmaceuticals USA (NYSE:TARO), and Sandoz. All the companies have agreed to settle the criminal charges by paying a certain amount of fines.

Meanwhile, Teva has put stringent compliance controls in place to avoid the recurrence of such incidents in the future. The pharmaceutical company is relieved that the case is over and is confident in its ability to address any potential civil litigation arising from the same conspiracy. Teva concluded by saying that it is “focussed on delivering high-quality medicines to the patients around the world who need them.”

Is Teva a Good Buy Now, as per Analysts?

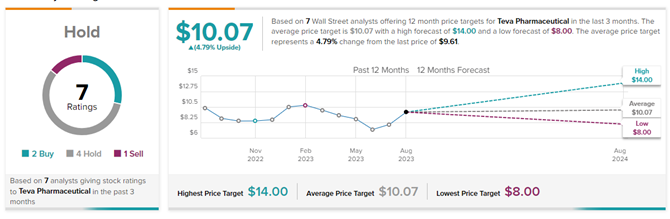

With two Buys, four Holds, and one Sell rating, Teva stock has a Hold consensus rating as per analysts. During its Q2FY23 results, Teva reported that it made a $200 million contingency during the quarter, which will be used to resolve a DOJ investigation into possible price-fixing concerns.

The good news is that the settlement amount is closer to the established fund amount. Following the Q2 earnings, Barclays analyst Balaji Prasad gave Teva a Buy rating, while Goldman Sachs analyst Nathan Rich reiterated his Hold rating on the stock.

On TipRanks, the average Teva Pharmaceuticals price target of $10.07 implies 4.8% upside potential from current levels. Meanwhile, TEVA stock has lost 3.5% in the past six months.