Delta Air Lines’ (DAL) stock remains a Buy despite oversupply issues and the fallout from a recent computer outage. A strong balance sheet, reasonable valuation, and supportive economic conditions are reasons to stay bullish on this airline stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Delta’s Challenges are Not Insurmountable

Despite facing numerous challenges in recent months, there’s still reason to be bullish on DAL stock, as none of its problems are insurmountable. The big problem experienced at the airline was the CrowdStrike (CRWD) information technology failure that caused major disruptions to its operations over five consecutive days, resulting in customer disruptions and reputational damage. The carrier has said that the CrowdStrike outage is likely to knock $0.45 per share off its third-quarter earnings.

Delta is also dealing with domestic overcapacity issues, particularly from competing low-cost and ultra-low-cost rivals, which is pressuring revenue per available seat mile (RASM). The airline has reported a 2% decrease in RASM and has softened its sales guidance for Q3 of this year. The company’s management team has criticized low-cost airlines for putting too much supply into the market.

In addition, Delta TechOps, the airline’s maintenance arm, is facing difficulties in growing its third-party maintenance, repair, and overhaul business due to supply chain constraints. The industry is also battling higher labor costs, although Delta has implemented most of its post-pandemic pay raises. More broadly, Delta is facing pressure to innovate. The market is characterized by intense competition, with rivals pursuing similar business models as Delta, which focuses on premium travel and international destinations.

Why DAL Stock Could Fly Higher

Delta Air Lines’ problems can be overcome, which is why I remain bullish on the stock. Delta remains the U.S. leader when it comes to profitability. The company’s advantages extend beyond passenger revenues to areas such as its lucrative loyalty and credit programs. Delta has overtaken JetBlue (JBLU) as the largest carrier in Boston and American Airlines (AAL) at Los Angeles International Airport. Moreover, Delta is set to receive 34 new widebody aircraft over the next two years, enabling significant international expansion and the opening of more long-haul routes.

Delta has also struck a new partnership with Riyadh Air, which is likely to open new opportunities in the Middle East. With billions of dollars in funding from the Saudi Arabia Sovereign Wealth Fund, Riyadh Air is a company worth forming a partnership. Delta also has an improving balance sheet that shows growth in capital expenditures. Lastly, it’s important to note that economic trends such as declining interest rates should positively impact demand for air travel and vacations over the next year.

Delta Air Lines’ Valuation

Delta’s valuation is another reason to be bullish on the stock. The valuation looks attractive when we take into account debt and compare it to the stocks of competing U.S.-based airlines. DAL stock is currently trading at 7.3 times forward earnings estimates, which makes it more expensive than rival United Airlines (UAL) at 5.2 times earnings estimates but cheaper than American Airlines, which is trading at 10.4 times consensus earnings forecasts.

Delta is also the least indebted of the three airlines, with $25.9 billion in debt versus $34.3 billion at United and $39.5 billion at American. Moreover, Delta is the only one of the three carriers to pay a dividend, albeit a modest one that yields 1.4%. Analysts seem to agree that Delta’s earnings will continue to grow in the coming years, which should make the stock’s valuation more attractive to investors.

Is Delta Stock a Buy, According to Analysts?

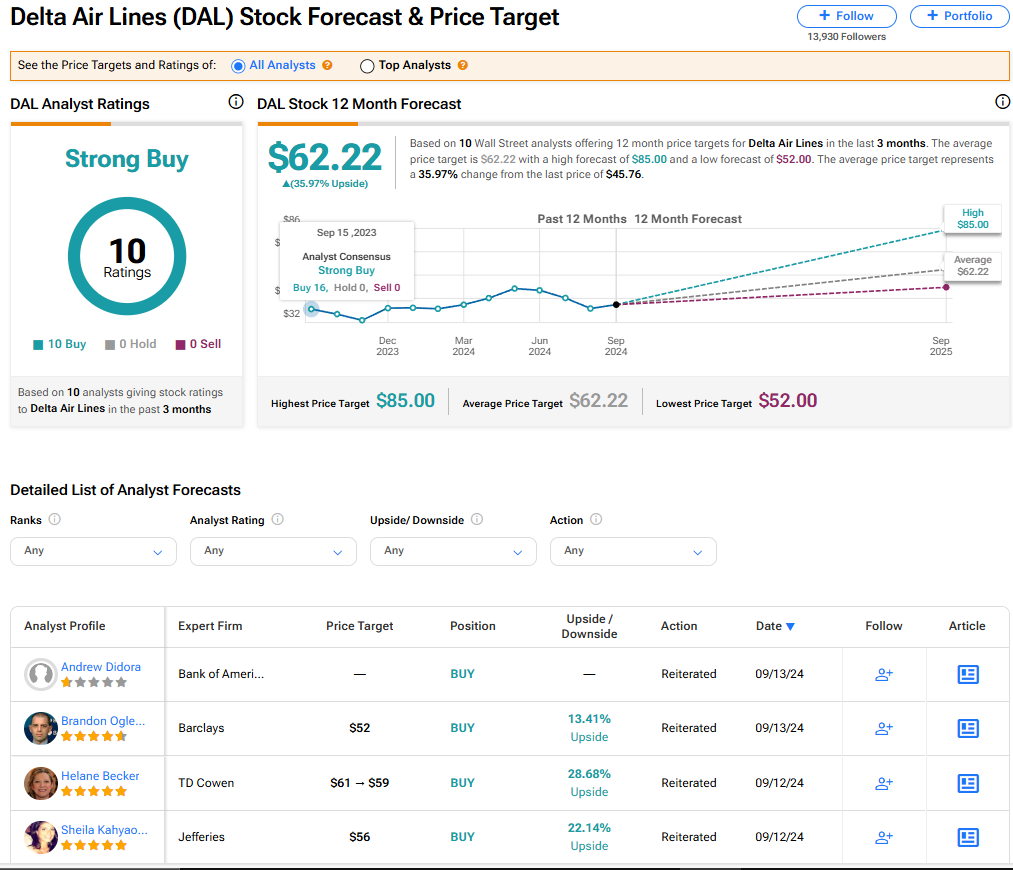

On TipRanks, DAL stock has a consensus Strong Buy rating. All 10 analysts who cover the airline rate its stock a Buy. Furthermore, the average Delta Air Lines stock price target of $62.22 implies 36% upside from where the shares currently trade.

It’s worth noting that DAL stock received four new Buy ratings on Sept. 12 and 13. Among them, Jefferies issued a price target of $56 a share, and TD Cowen reduced its price target from $61 to $59 but retained its Buy-equivalent rating. Sheila Kahyaoglu of Jefferies said that, despite the CrowdStrike outage this summer, Delta Air Lines would likely deliver earnings at the upper end of its guidance range for Q3.

Read more analyst ratings on DAL stock

Conclusion: DAL Stock Is Likely to Soar

Delta Air Lines trades at a considerable discount to its share price target, offers a dividend, and has an attractive valuation. There’s a lot to like about this leading U.S. airline despite some recent challenges that have led to a pullback in its share price. As a result, I have a Buy rating on DAL stock.