Shares of Carlyle Group (NASDAQ:CG) jumped over 6% in extended trading yesterday on news of inclusion in the S&P MidCap 400 index. Inclusion in the index implies increased liquidity and visibility for CG, along with the potential for greater inflows from passive investment funds that track the index. Carlyle Group will replace ICU Medical (NASDAQ:ICUI) in the S&P 400 index. CG has a market capitalization of $11.84 billion. The changes will be effective starting Thursday, November 30.

The S&P 400 MidCap Index is a benchmark index comprising 400 mid-size companies. The index reflects the distinctive risk and return characteristics of this mid-sized market capitalization segment.

Carlyle Group is an alternative asset management company that specializes in private equity, real assets, and private credit. Hailed as one of the largest funds in the world, CG currently boasts $382 billion in assets under management (AUM). CG stock has gained 14.4% so far this year.

Is Carlyle Group a Good Stock to Buy?

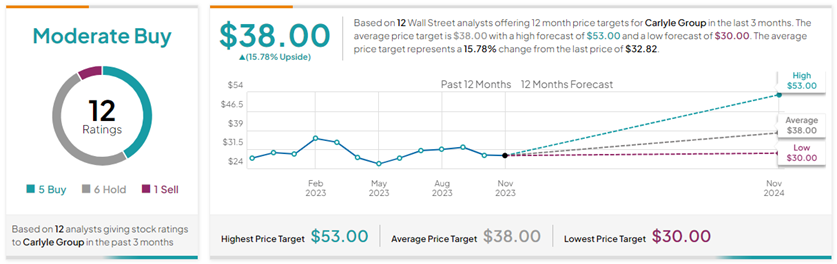

Wall Street is cautiously optimistic about CG stock. On TipRanks, the stock has a Moderate Buy consensus rating based on five Buys, six Holds, and one Sell. Also, the average Carlyle Group price target of $38 implies 15.8% upside potential from current levels.