Last week, tech giant Apple (AAPL) reported better-than-expected earnings and revenue for the fourth quarter of Fiscal 2024 (ended September 28, 2024). Despite beating Wall Street’s estimates for iPhone sales, AAPL shares fell as investors were concerned about the weakness in sales from China and the subdued revenue forecast for the Fiscal first quarter, which includes the crucial holiday season. Let’s look at how analysts reacted to the results.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Key Highlights of Apple’s Q4 Performance

Apple’s iPhone sales increased 5.5% year-over-year to $46.2 billion in Q4 FY24 and helped the company deliver a 6.1% rise in overall sales to $94.9 billion. While the company’s Mac and iPad product categories witnessed higher sales, sales from Wearables, Home, and Accessories fell 3.1%. Meanwhile, Services revenue grew 12% to $24.9 billion.

Investors were concerned about the 0.3% decline in revenue from Greater China to $15 billion, given that it is a key growth region for the company. Apple’s Greater China business is under pressure due to intense competition from players like Huawei. Looking ahead, the company expects the December quarter revenue to grow in the low- to mid-single-digit range year-over-year.

Analysts Raise Certain Concerns After AAPL’s Q4 Results

In reaction to the Q4 FY24 results, Maxim Group analyst Tom Forte raised the price target for Apple stock to $215 from $203. However, Forte retained a Hold rating on the stock, as he thinks that it is difficult to decide if Apple is in the early phase of an AI-fueled supercycle for iPhone upgrades, given the mismatch in the launch of iPhone 16 and the Apple Intelligence software as well as macro challenges in China.

Forte added that if there is a supercycle then based on management’s guidance, he believes that it is seeing a very slow start.

Meanwhile, Needham analyst Laura Martin reiterated a Buy rating on AAPL stock with a price target of $260. However, the analyst pointed out some drawbacks. Martin noted that Apple’s Q4 FY24 revenue growth of around 6% and operating margin improvement of 100 basis points was the lowest compared to Alphabet (GOOGL), Meta Platforms (META), and Amazon (AMZN), with generative-AI tailwinds driving higher operating margin expansion and accelerated top-line growth for these rivals.

Martin thinks that Apple’s “mental constraint” is that it establishes its timelines in one-year product cycles, whereas the ongoing generative AI war is reducing time frames into months. The analyst also highlighted that AAPL’s limitation is that it can only apply GenAI innovations to its own ecosystem, while Alphabet can apply GenAI to Android and can charge a fee to offer its large language model through its Cloud business to thousands of other companies. Overall, Martin concluded that while Apple’s ecosystem is sticky, its timeframes are outdated.

Is Apple Stock a Good Buy?

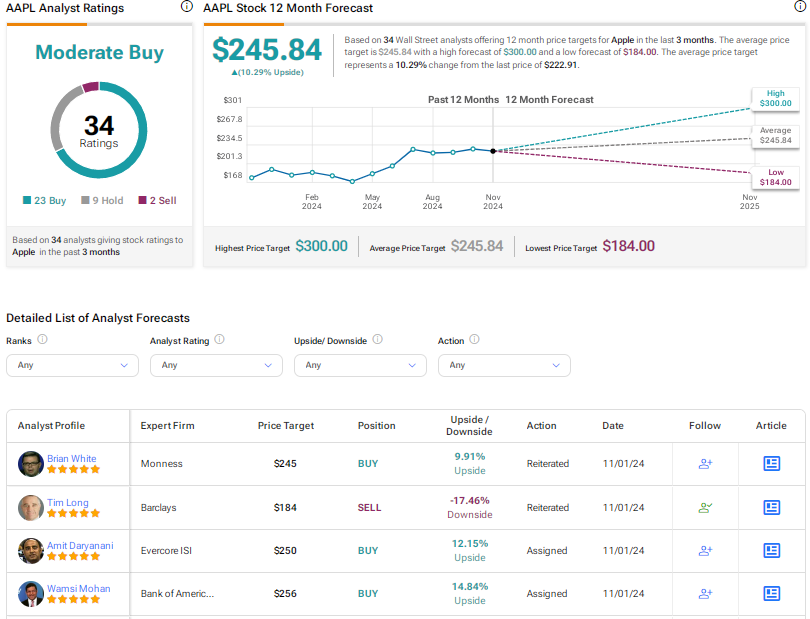

Overall, Wall Street is cautiously optimistic on Apple stock, with a Moderate Buy consensus rating based on 23 Buys, nine Holds, and two Sell ratings. The average AAPL stock price target of $245.84 implies 10.3% upside potential. Shares have risen about 16% so far this year.

With a quarterly dividend of $0.25 per share, Apple stock offers a yield of 0.43%.

Conclusion

While Apple’s Q4 FY24 results surpassed analysts’ estimates, weakness in China sales, concerns about the company lagging behind other tech giants in the AI race, and the muted guidance for the December quarter could weigh on investor sentiment over the near term.