HealthEquity (HQY), a prominent provider of technology-enabled Health Savings Accounts (HSAs), recently released an impressive financial report exhibiting substantial growth. The company boasted robust revenue and earnings beats for Q2, while HSA assets grew by 27% to $29 billion, marking significant progress. The stock is up over 18% year-to-date, with the company and Wall Street analysts forecasting further strong growth. HealthEquity is worthy of attention from investors interested in the intersection of health services and finance.

HealthEquity’s Growing Services

HealthEquity is a healthcare account management company that provides comprehensive solutions tailored to employers, health planners, brokers, consultants, and financial advisors. Its multifaceted service portfolio includes Health Savings Accounts (HAS), Flexible Spending Accounts (FSA), Health Reimbursement Arrangements (HRA), Dependent Care Reimbursement Accounts (DCRA), and 401(k) provisions, as well as Commuter, COBRA, and Healthcare Incentives Accounts.

The company utilizes technology-enabled platforms to provide services to consumers and employers across the United States.

With over 16 million total accounts, including 9 million HSAs, the company’s total accounts have grown by 9%. It holds $29 billion in HSA assets, up by $2.2 billion in the last quarter and $6.3 billion year-over-year, primarily due to strong sales and client infusion from acquiring BenefitWallet in May.

HealthEquity’s Recent Financial Results

The company recently reported its financial results for Q2 2024. Revenue of $299.9 million rose 23.1% year-over-year while beating analysts’ estimates by $14.78 million. Adjusted EBITDA increased 46% year-over-year, reaching $128.3 million. The company also reported a non-GAAP net income of $76.3 million, or earnings per share (EPS) of $0.86, greatly exceeding consensus expectations of $0.16.

Following second-quarter results, HQY’s management has offered guidance for the fiscal year ending January 31, 2025, projecting revenues from $1.165 billion to $1.185 billion. The anticipated net income is between $94 million and $109 million, equating to a non-GAAP net income of $265 million to $280 million, culminating in non-GAAP net income per diluted share of $2.98 to $3.14.

What Is the Price Target for HQY Stock?

The stock has been on a steady upward trend, climbing 17% over the past three years. It trades near the upper middle of its 52-week price range of $61.81 – $88.26 and demonstrates negative price momentum, trading below its 20-day (76.50) and 50-day (76.97) moving averages. With a P/B ratio of 3.0x, the stock trades in line with the Health Information Services industry average of 3.5x.

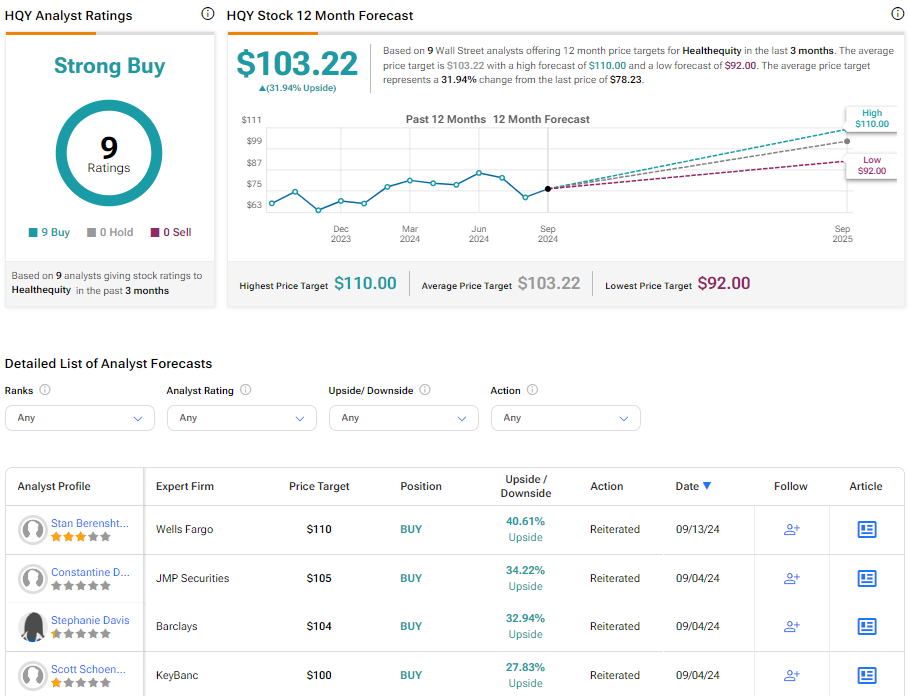

Analysts following the company have been bullish on HQY stock. KeyBanc analyst Scott Schoenhaus recently reiterated an Overweight rating and $100.00 price target on the shares, noting strong HSA account growth and cash generation profile and the potential to further grow revenue by gaining share in Health Savings Accounts markets both organically and opportunistically via acquisitions.

Overall, Healthequity is rated a Strong Buy based on nine analysts’ cumulative recommendations and price targets. The average price target for HQY stock is $103.22, representing a potential upside of 31.94% from current levels.

Bottom Line on HQY

HealthEquity has demonstrated substantial growth in revenue, earnings, and assets. The company’s expansive service portfolio, technology-enabled platforms, strategic growth through acquisitions, and favorable ratings from analysts underscore its potential for further growth. Combined with this, the stock’s positive trajectory and promising future projections make HQY an intriguing option for investors attracted to the crossroads of healthcare and finance.