HashiCorp, Inc. (NASDAQ:HCP) stock came under pressure on reports of increased regulatory scrutiny over its proposed acquisition by IBM (NYSE:IBM). Shares of HashiCorp, which provides multi-cloud infrastructure automation software, slipped approximately 1% on Thursday. Further, the stock was in the red in after-hours trading.

According to a tweet from Capitol Forum, the FTC is conducting a thorough review of IBM’s planned $6.4 billion acquisition of HashiCorp. This scrutiny focuses on potential impacts on competition within the cloud software and encryption tools sectors.

The Rationale Behind the Acquisition

IBM announced its intent to acquire HashiCorp in April for $35 per share in cash. The deal complements IBM’s transition towards a hybrid cloud and artificial intelligence (AI)-focused business model. Moreover, it will enable IBM to capitalize on the strong demand for AI and cloud technologies.

Further, the acquisition will expand IBM’s total addressable market and is expected to be margin-accretive.

While the FTC review adds uncertainty, IBM expects the transaction to close by the end of 2024.

Analysts See Merger Risks

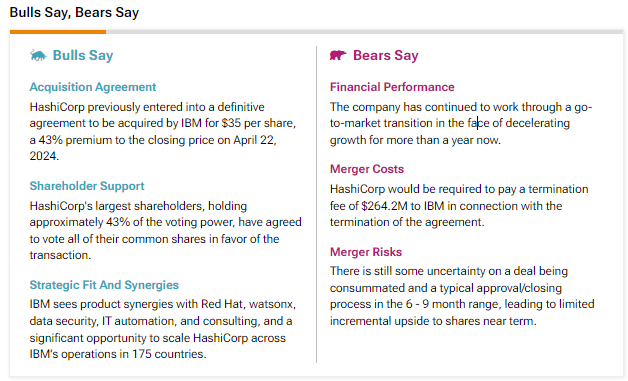

HashiCorp stock has gained about 14% since it was agreed to be acquired by IBM on April 24. However, TipRanks’ Stock Analysis tool, “Bulls Say, Bears Say,” shows that analysts bearish on HCP stock see merger risks and uncertainty over the deal.

Is HCP a Good Stock to Buy?

Given the uncertainty over the deal, Wall Street remains sidelined on HCP stock. With one Buy and 12 Hold recommendations, HCP stock has a Hold consensus rating. The analysts’ average HCP stock price target is $34.33, implying 3.16% upside potential from current levels.