Hasbro, Inc. (NASDAQ: HAS) has delivered mixed results for the second quarter of 2022. Earnings surprise in the quarter was 22.3%, and the sales surprise was a negative 2.2%. Mixed results, along with softness in revenue growth and lower cash flow projection for 2022, impacted investors’ sentiments.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of this $11.2-billion play and entertainment company inched up a mere 0.7% to close at $79.98 on Tuesday.

Highlights of Hasbro’s Q2 Results

Marginal growth in revenues and operational efficiency supported Hasbro’s bottom-line performance in the quarter. Adjusted earnings of $1.15 per share grew 10% year-over-year and surpassed expectations of $0.94 per share. The unfavorable movement in foreign currencies was a spoiler in the quarter.

Revenues were $1.34 billion in the quarter, up 1% (or 4% without the impact of forex woes) from the year-ago tally. The results benefited from healthy demand and product innovations, partially offset by weakness in the entertainment business.

Sales of the Consumer Products segment grew 7% year-over-year, driven by healthy business in Latin America and North America. The Wizards of the Coast and Digital Gaming segment’s sales advanced 3%, benefiting from a 15% increase in tabletop revenues, partially offset by a 36% decline in digital and licensed gaming revenues.

The Entertainment segment recorded a sales decline of 18%, due to weakness in film & TV, family brands, music, and other businesses.

The adjusted operating income in the quarter grew 14% year-over-year to $241 million, and adjusted earnings before interest, tax, depreciation, and amortization advanced 6%.

Diverse Use of Capital by Hasbro

In the first half of 2022, the company used $75.8 million for capital expenditures and $146.3 million on investments and acquisitions. In May 2022, Hasbro acquired D&D Beyond and strengthened the capabilities of its Wizards of the Coast business.

Also, the company used $152.5 million to repay long-term debts. Its long-term debt stood at $3,739 million at the end of the first half. Share buybacks stood at $124 million, and dividend payments totaled $191.9 million in the first two quarters of 2022.

Cash and cash equivalents at the end of the first half were $628.2 million. Notably, cash flow from operating activities in the first half was $147.8 million.

The CEO of Hasbro, Chris Cocks, said, “Backed by Hasbro’s unmatched portfolio of brands and brand-building capabilities, we have confidence in the strength of our initiatives for the second half and we are positioned to deliver profitable growth and long-term shareholder returns.”

Hasbro’s Projections for 2022

For 2022, the company anticipates sales (excluding the impact of forex woes) to grow in the low-single digits. Operating profit is forecast to increase in the mid-single digit, and the operating margin is expected to be 16%.

Operating cash flow is expected at the lower end of the $700-$800 million range given previously.

Wall Street Is Cautiously Optimistic on HAS Stock

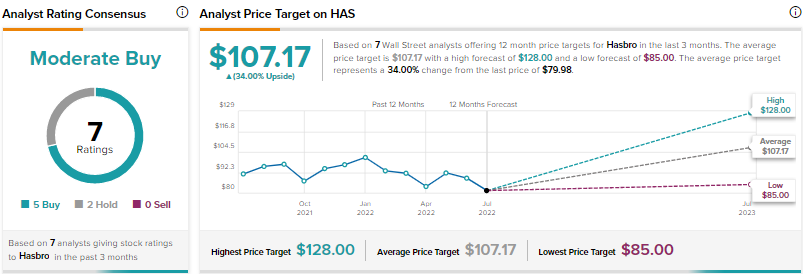

On TipRanks, analysts are cautiously optimistic about the prospects of Hasbro and have a Moderate Buy consensus rating based on five Buys and two Holds. HAS’ average price forecast is $107.17, reflecting upside potential of 34% from the current level. Shares of Hasbro have declined 14.9% over the past year.

Following Hasbro’s second-quarter results, Stephanie Wissink of Jefferies reiterated a Buy rating on Hasbro with a price target of $100, suggesting upside potential of 25.03%.

Website Traffic Hinted at Hasbro’s Top-Line Performance

According to TipRanks, the total estimated visits to the company’s website declined 15.13% year-over-year in April and 9.49% in May. The same advanced 9.98% in June. For the second quarter, the traffic decreased 4.75% year-over-year.

The estimated footfall on the website reflects Hasbro’s lackluster top-line performance.

Key Takeaways for Hasbro’s Investors

Despite softness in top-line numbers, Hasbro is well-positioned to benefit from its solid portfolio of product brands and efforts to innovate more of its exciting products. Its focus on improving operational efficiency is advantageous. However, lower cash flow projections for 2022 are concerning.

Learn how Website Traffic can help you research your favorite stocks.

Read full Disclosure