Motorcycle manufacturer Harley-Davidson (HOG) has revised its diversity, equity, and inclusion (DEI) initiatives following an ongoing campaign initiated by activist Robby Starbuck. This adjustment is part of a broader shift among companies re-evaluating their corporate social responsibility goals.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Wondering why companies pursue DEI initiatives? Well, these strategies aim to reduce workplace disparities and promote a more inclusive environment.

Major Changes

The company announced that it will no longer participate in the Human Rights Campaign’s corporate equality index, a benchmark for LGBTQ+ employee inclusion. Further, Harley-Davidson clarified that it will review all sponsorships, focusing on retaining its “loyal riding community,” and will no longer set spending goals for suppliers owned by minorities or women.

The company also announced that its employee training materials will now be strictly business-focused, removing any “socially motivated content.” With these changes, Harley-Davidson aims to concentrate on promoting motorcycling and maintaining its core customer base.

Growing Industry Trend

The changes came after weeks of online criticism led by conservative activist Robby Starbuck, who has similarly targeted other companies, such as Tractor Supply (TSCO) and Deere (DE), with his campaigns.

Robby Starbuck, who has a large following on X (formerly Twitter), has used social media to challenge companies he believes are overly focused on DEI initiatives.

Is HOG a Good Stock to Buy?

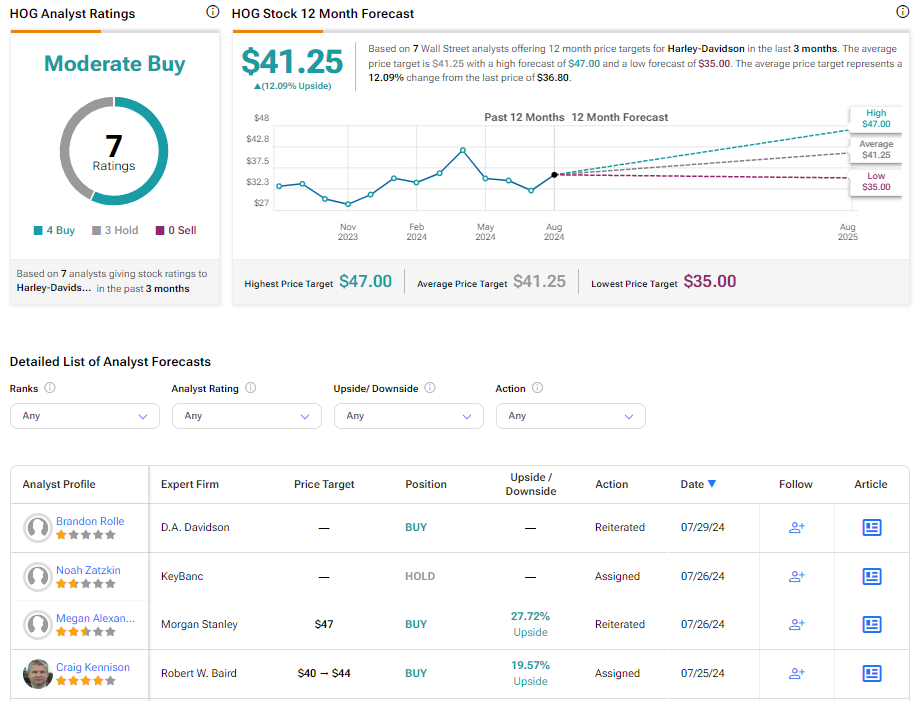

On TipRanks, HOG has a Moderate Buy consensus rating based on four Buy and three Hold ratings. The analysts’ average price target on Harley-Davidson stock of $41.25 implies an upside potential of 12.09%. Shares of the company have gained 5.3% in the past three months.