Iconic motorcycle brand Harley-Davidson’s (HOG) recent Q2 results comfortably exceeded top-and-bottom-line expectations. Despite facing headwinds with sales declines in most markets, caused by harsh economic reality, the Q2 beats and the announcement of a plan to buy back $1 billion in its outstanding shares have helped the shares jump over 14% in the past month. Furthermore, Morgan Stanley’s (MS) recent proposition that Harley-Davidson is a possible takeover target provides another layer of intrigue.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Even if an acquisition fails to materialize, anticipated interest rate cuts could make financing more accessible for consumers making big-ticket purchases, potentially fostering a re-rating of the shares. Harley-Davidson exhibits unique potential for income-oriented value investors with a dividend yield of 1.80% and shares trading at a discount to industry peers.

Harley’s Segmented Approach

Harley-Davidson is a global motorcycle manufacturer and seller with international operations. The company’s structure is divided into three key segments: The Harley-Davidson Motor Company, LiveWire, and Harley-Davidson Financial Services.

The Harley-Davidson Motor Company offers a range of motorcycles, from cruisers to sport bikes, along with a suite of motorcycle parts, accessories, and apparel. LiveWire is dedicated to producing and selling electric motorcycles and balance bikes for children. Harley-Davidson Financial Services offers wholesale and retail financing services.

Harley’s Recent Financial Results & Outlook

The company recently reported financial results for Q2 of 2024. Revenue of $1.36 billion exceeded analysts’ estimates of $1.28 billion while marking a 12% year-over-year increase. Motorcycle sales rose by 20%, but there were declines in parts and accessories (down 10%) and apparel (down 4%), narrowing the gross margin to 32.1%, a 270 basis point year-over-year decline. Additionally, the company witnessed decreased sales in most markets except Latin America.

Amidst these trends, one bright spot was a substantial 379% increase in sales of electric motorcycles in Q2 compared to the same period last year. Still, the company outperformed expectations by reporting earnings per share (EPS) of $1.63, surpassing analysts’ estimates of $1.41.

The company announced a new plan to repurchase $1 billion of its outstanding common stock by 2026. The repurchase will be funded from operational cash flow. This new plan replaces existing share repurchase plans and is in addition to the $875 million in share repurchases completed since 2022.

Management has issued guidance for 2024, anticipating a decline in revenue by 5-9% relative to 2023, with an operating income margin of 10.6-11.6%. LiveWire’s electric motorcycle sales are expected to be 1,000-1,500 units, albeit with an operating loss between $105-$115 million. Finally, the company is projected to make capital investments ranging from $225-$250 million.

What Is the Price Target for HOG Stock?

The stock has been range-bound for the past three years, returning 0.78%. It trades toward the middle of its 52-week price range of $25.43 – $44.16 and demonstrates positive price momentum, trading above the 20-day (35.31) and 50-day (34.97) moving averages. With a P/E ratio of 7.64x, it trades at a discount to industry peers, with the Recreational Vehicle industry P/E average at 14.35x.

Analysts following the company have been cautiously optimistic about the stock. For instance, Citi analyst James Hardiman recently raised the price target on the shares from $34 to $35 while maintaining a Neutral rating, noting that ongoing temporal headwinds may outweigh cyclical tailwinds into 2025.

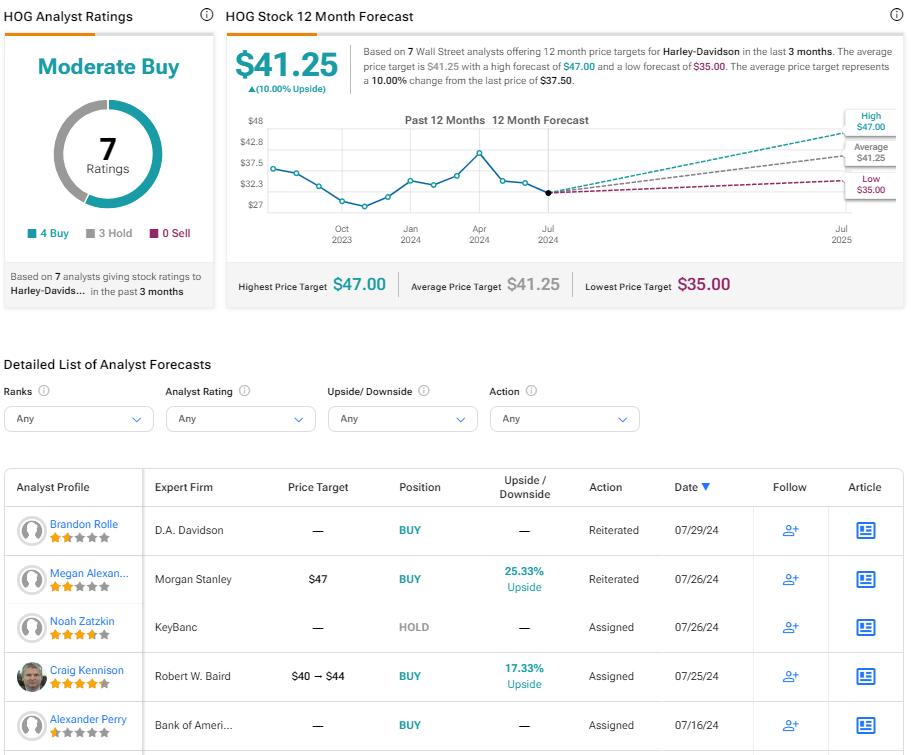

Based on seven analysts’ recommendations and price targets, Harley-Davidson is rated a Moderate Buy overall. The average price target for HOG stock is $41.25, representing a potential 10.00% upside from current levels.

Final Thoughts on Harley-Davidson

Despite facing challenges, Harley-Davidson continues to outperform expectations, producing revenue and motorcycle sales surges while showing promising growth in electric motorcycle sales. Notably, the company has announced a plan to repurchase $1 billion of its outstanding shares by 2026, returning significant capital to shareholders. Its discounted trading price and solid dividend yield make Harley-Davidson a compelling prospect for long-term income-oriented value investors.