Guess? (NSYE:GES) stock collapsed 14.3% in after-hours trading yesterday on missing third-quarter Fiscal 2024 expectations. What’s worse, the clothing retailer slashed its outlook for the full year owing to the “uncertain shopping environment” and dimming consumer confidence. Year-to-date, GES stock has gained 16.6%.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In Q3FY23, Guess posted adjusted earnings of $0.49 per share, which fell short of the consensus of $0.61 per share. In the prior-year quarter, the company posted adjusted earnings of $0.44 per share. Further, net revenue of $651.17 million grew 3% year-over-year but came in lower than the analysts’ estimates of $655.52 million.

Guess Slashes Fiscal 2024 Outlook

Looking forward, Guess now expects Fiscal 2024 net revenue to grow between 1.8% and 2.4%, down from its prior forecast of between 2.5% to 4%. Similarly, the revised outlook for adjusted earnings is in the range of $2.67 and $2.74 per share, lower than the prior outlook of between $2.88 and $3.08 per share.

Moreover, Q4FY24 net revenues are projected to grow between 4% and 6%. Adjusted earnings for the fourth quarter are expected ti be between $1.53 and $1.60 per share. Additionally, the board approved a regular quarterly dividend of $0.30 per share, reflecting a current yield of 4.39%.

Is Guess a Good Investment?

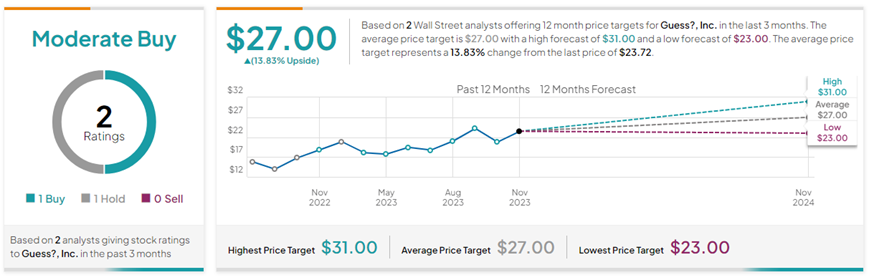

With one Buy versus one Hold rating, Guess stock has a Moderate Buy consensus rating. On TipRanks, the average Guess? price target of $27 implies 13.8% upside potential from current levels.