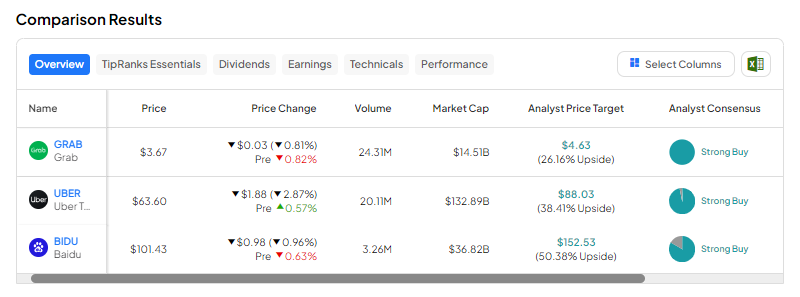

Investor sentiment, which reflects the general mood among traders regarding a particular stock, could be a valuable consideration for investors when picking stocks. Positive sentiment generally indicates that investors are confident about a company’s future. Using the TipRanks Stock Screener tool, we have shortlisted three stocks with “Very Positive” investor sentiment and more than 10% upside potential projected by analysts: Grab (NASDAQ:GRAB), Uber (NYSE:UBER), and Baidu (NASDAQ:BIDU).

Let’s take a closer look at these three stocks.

Grab Holdings Inc. (GRAB)

Grab is a technology company that offers ride-hailing, food delivery, and digital payment services. The company is gaining from strong demand for its advertising business and a surge in tourism, which is benefiting its ride-hailing business.

Out of the 736,049 portfolios tracked by TipRanks, 0.2% hold GRAB stock. In the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 25.4%.

On TipRanks, the stock has a Strong Buy consensus rating based on 11 unanimous Buy ratings. The analysts’ average price target on GRAB stock of $4.61 implies 25.6% upside potential from current levels. Over the past six months, shares of the company have gained 17.6%.

Uber Technologies (UBER)

Uber provides ride-hailing, food, and package delivery services. Investment in new growth opportunities, a growing number of drivers on its platform, and a focus on strengthening its delivery business bode well for Uber’s future performance.

Overall, among the 736,049 portfolios monitored by TipRanks, 1.8% have invested in UBER stock. Also, the number of portfolios holding the stock increased by 4.1% in the last 30 days.

Overall, Wall Street is optimistic about the stock. The stock has a Strong Buy consensus rating based on 31 Buys and one Hold. The analysts’ average price target on UBER stock of $88.03 implies a 38.41% upside potential from current levels. Shares of the company have gained 15% over the last six months.

Baidu, Inc. (BIDU)

BIDU is a Chinese multinational technology company. Its strategic moves in integrating artificial intelligence (AI) into its core services and growing momentum in its advertising business are impressive.

Out of the 736,049 portfolios tracked by TipRanks, 0.8% hold BIDU stock. Furthermore, in the last 30 days, 13.4% of those holding the stock increased their positions.

BIDU has received 15 Buy and three Hold recommendations for a Strong Buy consensus rating. The analysts’ average price target on Baidu stock of $152.53 suggests an upside potential of 50.4%. Shares of the company have declined 17.8% over the past six months.

Concluding Thoughts

Investors seeking stocks with growth potential might want to consider GRAB, UBER, and BIDU. Positive sentiments from retail investors reflect their confidence in these stocks’ future performance. It is worth noting that investors can use TipRanks’ Experts Center tool to discover top stock picks as well.