Gap (NYSE:GPS) reported better-than-expected results for the fourth quarter of Fiscal 2023. The stock gained about 6% in the extended trading session yesterday.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

GPS is a global apparel retail company known for its brands Gap, Old Navy, Banana Republic, and Athleta.

Q4 Earnings Snapshot

The company reported adjusted earnings of $0.49 per share, significantly higher than the consensus estimates of $0.23 per share. In the year-ago period, GAP recorded an adjusted loss of $0.75 per share.

Meanwhile, Gap’s quarterly sales rose about 1% year-over-year to $4.3 billion and surpassed the Street’s estimates of $3.27 billion. Further, comparable sales remained flat compared to the prior-year period. Gap’s store sales witnessed a 4% year-over-year increase, while online sales fell 2%.

Brand-wise, Q4 same-store sales at Old Navy and Gap climbed 2% and 4%, respectively, and compared favorably with a fall of 7% and 4% in the year-ago quarter. However, Banana Republic and Athleta’s same-store sales were down 4% and 10%, respectively, compared with a 3% and 5% decline.

Outlook

For the full year, Gap expects sales to remain flat on a year-over-year basis and operating income to increase by a low to mid-teens percentage. The company’s outlook is based on the assumption that the uncertain consumer and macro environment will continue to persist.

In the Fiscal first quarter, GPS expects net sales of around $3.3 billion.

Is GPS a Good Stock to Buy?

The company’s strong cash position keeps Gap well poised to undertake capital deployment activities. Investors should note that GPS stock has an impressive dividend yield of 3%, much above the consumer cyclical sector average of 1%.

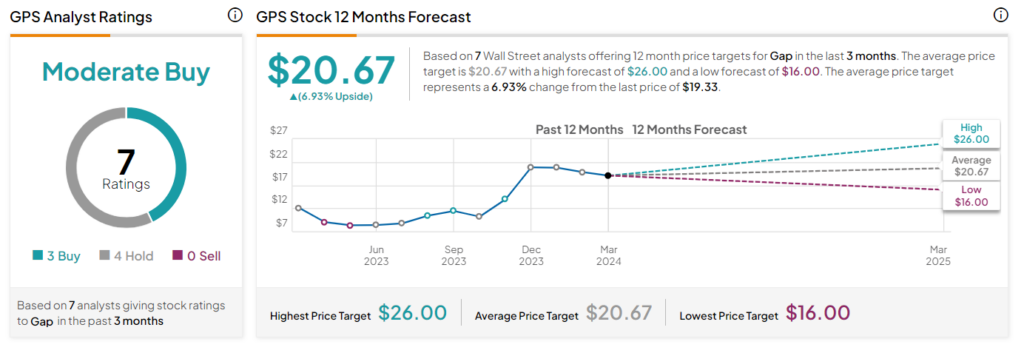

Wall Street remains cautiously optimistic about Gap stock. On TipRanks, it has a Moderate Buy consensus rating based on three Buys versus four Holds ratings. Also, the average Gap price forecast of $20.67 implies 6.9% upside potential. Shares of the company have gained over 75% in the past six months.