Google’s (GOOGL) 20% commission on ad transactions through its platform was under extensive scrutiny from the U.S. Justice Department at the end of the first week of the antitrust trial, according to a Verge report. The U.S. Justice Department has argued that the fee charged by the tech giant is higher than any competitor’s fee and, as a result, reflects Google’s monopoly over online ads.

Google’s High Fees Take Center Stage

In the first week of the DOJ’s second antitrust trial against Google, Google’s “take rate” took center stage. The commission cited internal documents and testimony from former Google ads executive Chris LaSala to highlight that Google faced no real pricing pressure due to its dominance. According to the emails presented in court, Google executives, including LaSala, questioned whether the 20% fee for its AdX exchange was sustainable and noted that the market rate was closer to 10%.

As the trial continues this week, YouTube CEO and former Google ads executive Neal Mohan is set to testify.

DOJ Accuses Google of AdX Monopoly

The crux of the DOJ’s case is that Google is accused of monopolizing the technology for buying and selling online display ads through its AdX exchange. The company allegedly controls a vast pipeline of products used by websites and advertisers, along with an exchange that connects ad buyers and sellers. This level of control raises concerns about competitive fairness and market dominance.

GOOGL’s Regulatory Woes Have Left Analysts Concerned

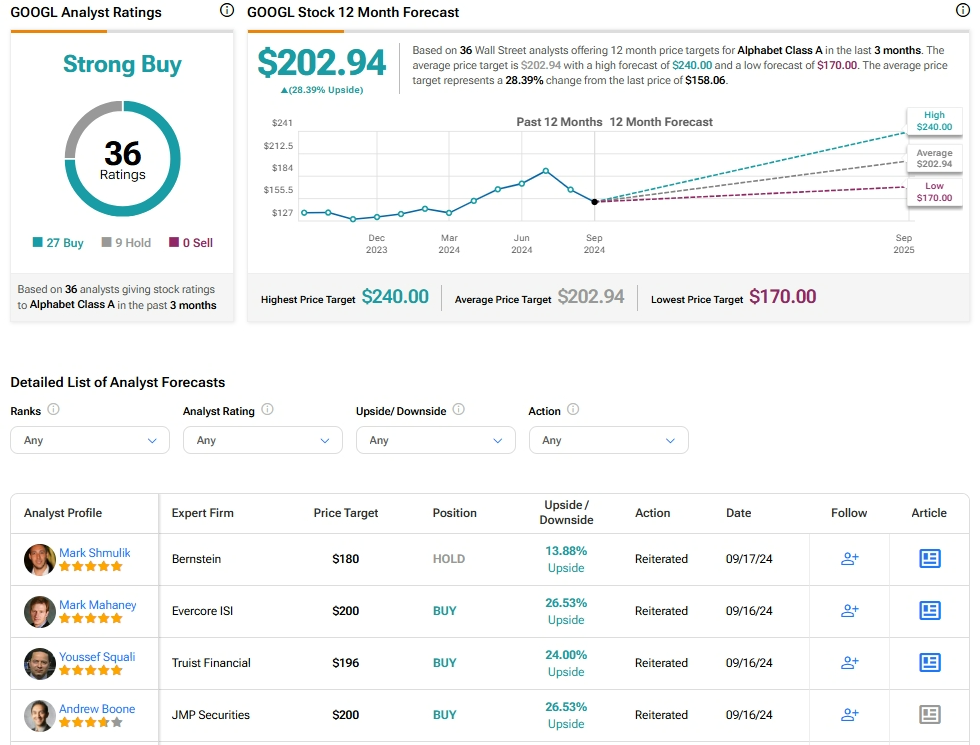

Amid these ongoing challenges, Google’s regulatory woes have left Wall Street analysts cutting their price targets on the stock but remaining bullish about the company. Besides the company’s antitrust trial in the U.S., GOOGL was also recently under scrutiny in Europe. Last week, Europe’s highest court, the European Court of Justice (ECJ), upheld a €2.4 billion ($2.65 billion) fine against the tech giant.

As a result, five-star Evercore analyst Mark Mahaney slashed his price target to $200 from $225, while reiterating a Buy on the stock. The analyst lowered the price target due to concerns about antitrust trials and possible outcomes. However, he remained optimistic, arguing that even in a worst-case scenario, where Google loses its ability to bid for exclusive search distribution deals in the U.S., the reduction in traffic acquisition costs would largely offset the impact. Traffic acquisition costs are the payments made by online search companies to affiliates for directing traffic to their websites.

Mahaney noted, “Google could lose up to 60% of its exclusive search revenue and still face only a single-digit percentage drop in EPS.”

What Is the Target Price of GOOGL Stock?

Analysts remain bullish about GOOGL stock, with a Strong Buy consensus rating based on 27 Buys and nine Holds. Over the past year, GOOGL has increased by more than 10%, and the average GOOGL price target of $202.94 implies an upside potential of 28.4% from current levels.