According to a report published by Reuters, General Motors Co. (NYSE: GM) has extended the production halt of its Chevrolet Bolt EV until early April. However, it plans to resume retail sales soon.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company plans to resume Bolt production at its plant in Orion Township, Michigan, in the first week of April.

The automaker widened a recall of Bolt in August last year to over 140,000 vehicles. The recall, which was aimed at replacing the EV’s battery modules, was triggered by reports of fires in parked vehicles. The company had stopped the production and retail sales of Bolt at the same time.

GM said the production halt “has enabled us to prioritize battery module replacements,” and it is confident that it can “balance replacements along with new retail production.”

About GM

Detroit-based GM designs, manufactures and sells cars, trucks, and automobile parts. Its brands include Chevrolet, Buick, GM, and Cadillac.

Shares of the company closed 2.6% up on Wednesday. The stock, however, lost 0.1% in the extended trading session to end the day at $49.60.

Wall Street’s Take

Last week, Nomura analyst Anindya Das downgraded the rating on GM to Hold from Buy and lowered the price target to $56 from $66 (12.7% upside potential).

Das believes that, in the short term, the company’s investments in EVs will not be as profitable as gasoline cars.

Additionally, Adam Jonas of Morgan Stanley (NYSE: MS) also downgraded the stock from Buy to Hold and reduced the price target from $75 to $55 (10.7% upside potential).

In a note to investors, Jonas said, “While GM has big plans for its new line of electric vehicles, there is rising execution risk on an absolute and relative basis more than we previously believed.”

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys and 5 Holds. The average General Motors price target of $74.27 implies 49.5% upside potential. Shares have lost 18.8% year-to-date.

Website Traffic

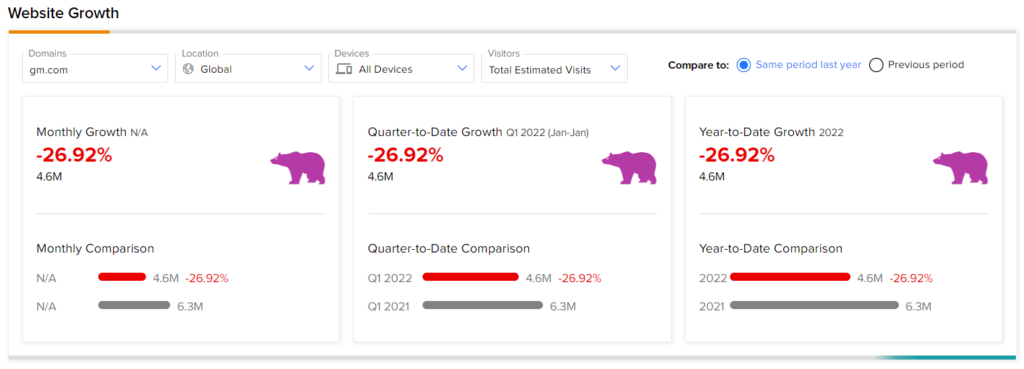

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into GM’s performance.

According to the tool, compared to the previous year, GM’s website traffic has registered a nearly 27% decline in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Resonant Shares Jump 260% on Acquisition by Murata

Glencore 2021 Profit Nearly Doubles

3M Company Updates 1 Key Risk Factor