ASX-listed Wesfarmers Limited (AU:WES) will pay its final dividend for the Fiscal Year 2023 next week. The company has declared a fully franked final dividend of AU$1.03 per share, reflecting a 3% increase from the FY22 final dividend of $1 per share. As a result, the full-year ordinary dividend reached AU$1.91 per share, marking a 6.1% year-over-year increase. The final dividend will be paid on October 5, 2023, to the shareholders registered until August 30. The current dividend yield stands at 3.79%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Wesfarmers is an Australian company with a diversified portfolio of businesses, including retail, industrial products, health and beauty, chemicals, fertilizers, and many more.

The company is known for its consistent track record of providing attractive dividend yields to shareholders. The company’s stable cash flow and strong financial position, driven by its diverse business operations, enable it to maintain a regular distribution of dividends. In August, the company published its FY23 earnings report, delivering another year of growth. In FY23, the company achieved an 18.2% increase in revenue, reaching $43.55 billion. Earnings before interest and tax (EBIT) grew by 6.3% to AU$3.86 billion, and net profit after tax (NPAT) saw a 4.8% increase, reaching AU$2.47 billion.

WES Dividend Forecast FY24

The growth in revenue for Wesfarmers’ major segments, namely Bunnings, Kmart Group, and WesCEF, decreased in the latter half of fiscal 2023. Collectively, these three segments contributed to over 90% of earnings from operations. The company maintained a mixed outlook for FY24, as operational performance will be offset by cost pressures.

According to the current estimates on Commsec, Wesfarmers is expected to pay an annual dividend per share of AU$1.92 in FY24. This projection represents a marginal increase compared to the FY23 payout of $1.91 per share.

Is Wesfarmers Shares a Good Buy?

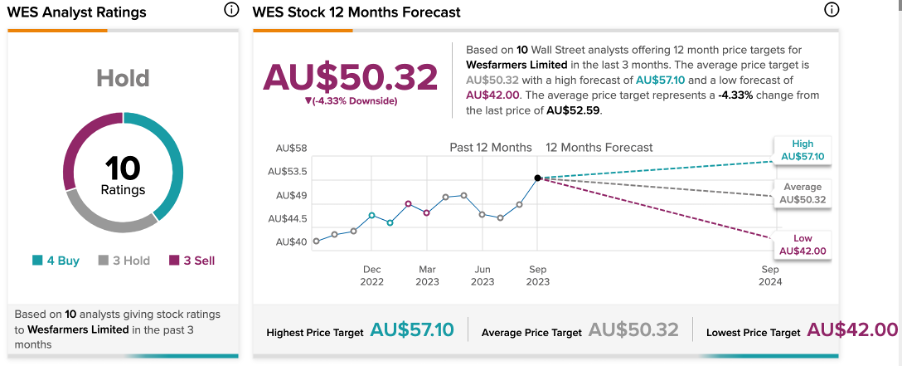

According to the rating consensus on TipRanks, WES stock has received a Hold rating, supported by 10 analysts’ recommendations. The Wesfarmers share price forecast is AU$50.32, representing a 4.3% decrease from the current price level.