In major news on UK stocks, International Distribution Services PLC (GB:IDS) has approved a £3.57 billion deal to sell its postal services brand, Royal Mail, to Czech billionaire Daniel Křetínský. According to a statement released by IDS, it has accepted the 370p per share offer from Křetínský’s EP Group. Křetínský currently holds the largest stake in IDS, amounting to 27.5%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Following the announcement, IDS stock has gained almost 4% as of writing.

International Distribution Services provides postal and courier services. The company owns Royal Mail and GLS, an international parcel service provider.

More on the Royal Mail Takeover

In addition to the cash offer of 360p per share, the Royal Mail takeover deal’s valuation comprises a dividend of 2p per IDS share and a special dividend of 8p per IDS share. The total deal value represents a premium of 72.7% over the IDS closing price on April 16, 2024, which was the last business day before the start of the offer period.

The proposed takeover is subject to approval from shareholders as well as the government.

Royal Mail: Farewell to Turbulent Years?

Royal Mail, which was once an iconic British institution, has faced challenges in recent years, experiencing a notable decline in service demand. Since its privatization in 2013, Royal Mail has been plagued by strikes and increasing competition from companies such as Amazon (NASDAQ:AMZN). Most recently, Royal Mail reported a loss of £348 million in FY24.

Kretinsky acknowledges his respect for Royal Mail’s history and tradition. Both IDS and EP have also reached an agreement stipulating that there will be no change in control of Royal Mail or GLS, for three years following the completion of the deal. Royal Mail will also maintain its headquarters and tax residency in the UK.

Additionally, both parties have made several commitments to the UK government, including maintaining Royal Mail’s “universal service” for five years and ensuring a consistent pricing model for delivery across the UK.

What is the Target Price for IDS?

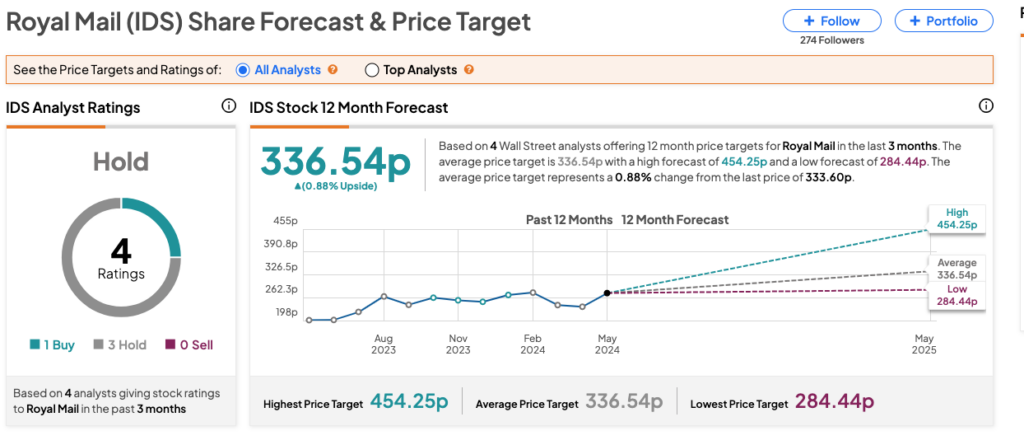

According to TipRanks, IDS stock has received a Moderate Buy rating, backed by one Buy and three Hold recommendations. The IDS share price target is 336.54p, which is almost similar to current trading levels.

Year-to-date, IDS stock has gained 22.3% in trading.