In news on UK stocks, shares of Wincanton plc (GB:WIN) fell 4.3% yesterday after French shipping giant CMA CGM withdrew its bid to acquire the British logistics company. The news comes as American player GXO Logistics (NYSE:GXO) offered a higher cash bid to acquire Wincanton on February 29, 2024.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Details About CMA CGM’s Withdrawal

CMA CGM was given four business days by the UK Takeover Panel to decide whether or not it intends to enhance its offer after GXO’s bid. However, CMA CGM’s Ceva Logistics UK Rose Ltd subsidiary, which was supposed to go ahead with deal, believes that their already revised offer of 480p per share (450p per share bid earlier) was a “very attractive opportunity for all Wincanton stakeholders.” Thus, the company withdrew its offer to buy Wincanton on March 5.

For French billionaire Saadé family-owned CMA CGM, acquiring Wincanton would have opened the doors to its logistics ambition and a gateway to the U.K. grocery and retail sector. The pullout from the race to buy Wincanton poses a setback to CMA CGM’s ambitions to strengthen its logistics arm.

Meanwhile, Wincanton gears up for GXO’s bid of an all-cash offer of 605p per share, valuing the company at GBP762 million. GXO is the only bidder in the race as of now and the deal will most probably go through. GXO aims to enter into the very lucrative logistics markets of the UK and Ireland through Wincanton. The bidding war suggests stiff competition and ongoing consolidation in the logistics and supply chain industry. Companies are trying to gain a larger share of the market as economies open up and fuel the possibility of higher global trade.

Are Wincanton Shares a Good Buy?

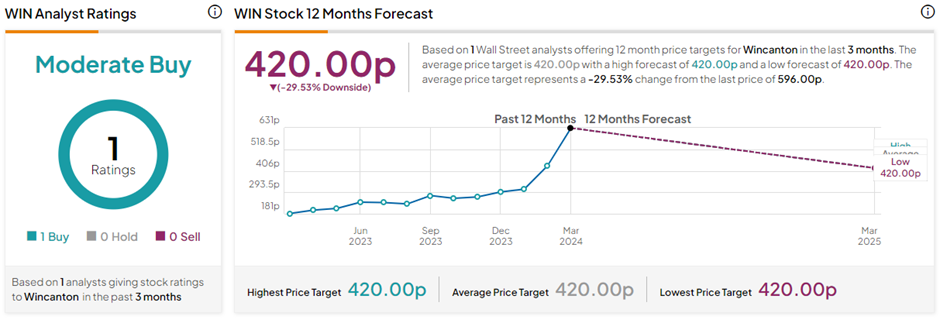

With only one Buy rating received during the past three months, WIN stock has a Moderate Buy consensus rating on TipRanks. The Wincanton plc share price target of 420p implies 29.5% downside potential from current levels. Please note, this rating was given before CMA CGM’s withdrawal and GXO’s bid, and is subject to change.