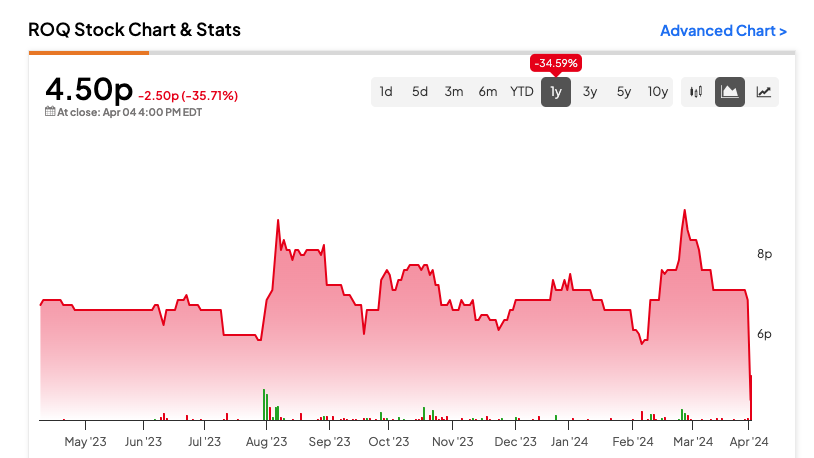

In key news on UK stocks, the share price of Roquefort Therapeutics PLC (GB:ROQ), earlier known as Roquefort Investments, crashed around 38% in the last two days, prompting the company to halt its fundraising efforts. According to its statement, the company announced that it had enlisted advisers to explore the possibility of fundraising. However, the incorrect speculations about the placing price led to a sharp decline in its share price. As a result, the board has opted not to pursue any potential placement at this moment.

Roquefort Therapeutics PLC is a biotechnology company specializing in the development of pre-clinical medicines targeted at challenging cancers.

Licencing Deal on the Cards

Roquefort further stated that it remains committed to finalizing an out-licensing agreement with pharma partners in 2024. The company has earlier stated that it has made notable progress in its pre-clinical drug development programs and is currently engaged in discussions with various potential partners.

In its February update, the company reported significant progress in its research on MK cells combined with natural killer (NK) cells. This combination showcased an effective cancer-killing effect across a range of cancer types, including solid tumors, lymphoma, and leukemia. This seems to represent a particularly encouraging opportunity for the company in terms of its commercial potential.

Year-to-date, the stock has lost almost 50% of its value.