In major news on UK stocks, Ashtead Group (GB:AHT) is reportedly mulling a U.S. listing, indicating yet another potential blow for the London Stock Exchange (LSE). As per the Sunday Telegraph, the heavy machinery rental company is in the initial stages of considering a U.S. listing. The move comes as a growing number of UK-based companies are abandoning LSE to seek higher valuation in the U.S. stock market.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The companies that have exited the UK stock market or have opted for listing in the U.S. include building materials firm CRH (GB:CRH) (NYSE:CRH), betting company Flutter Entertainment (GB:FLUT) (NYSE:FLUT), and plumbing and heating products company Ferguson (GB:FERG) (NYSE:FERG)

Reasons for Ashtead’s Interest in a U.S. Listing

Aside from the possibility of gaining a higher valuation, Ashtead is contemplating a U.S. listing as close to 90% of its business is from North America. In the first nine months (ended January 31, 2024) of Fiscal 2024, the company’s North American operations accounted for 92% of the overall revenue. The U.S. business alone accounted for about 86% of the top line in the first nine months of Fiscal 2024.

Moreover, Ashtead’s U.S. business is highly profitable and contributed $2.08 billion of the overall profit of $2.19 billion in the first nine months of Fiscal 2024.

It is worth noting that Ashtead is significantly benefiting from the Inflation Reduction Act in the U.S. In its March trading update, the company said that demand in its end markets in North America is solid, supported by the growing numbers of mega projects and recent legislative acts.

What is the Target Price for Ashtead?

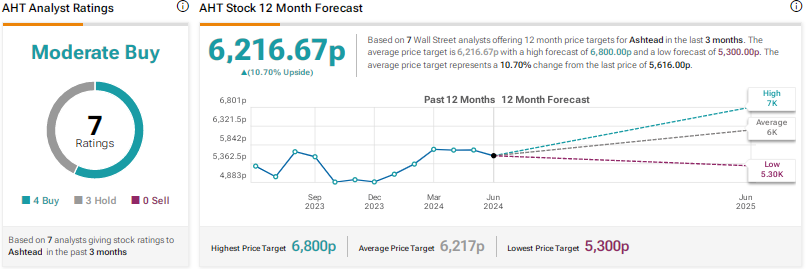

Analysts have a Moderate Buy consensus rating on Ashtead stock based on four Buys and three Hold recommendations. The average AHT stock price target of 6,216.67p implies 10.7% upside potential. Shares have advanced 5% in the past year.