The FTSE 250-listed Hays PLC (GB:HAS) shares declined over 7% today after the U.K. recruiter issued a profit warning due to a hiring slowdown in most of its markets. In its quarterly trading update, the company stated that its half-year earnings are anticipated to fall below expectations following a challenging December.

The company will publish its trading update for H1 FY24 on February 22, 2024.

Hays is a global recruitment company serving 33 countries in over 20 diverse areas of specialization.

Highlights of the Trading Update

According to its Q2 FY24 update, the company experienced a 12% year-on-year drop in its group fees, triggered by an 18% drop in permanent hiring. Regionally, the Australia and New Zealand division saw a substantial drop of 24% in net fees, followed by a 17% reduction in the UK and Ireland division.

Consequently, the company now expects its first-half operating profit to be around £60 million, falling short of the current market consensus of £73 million.

On the plus side, the company has successfully implemented cost-cutting measures in the first half of FY24, which are projected to generate approximately £30 million in annualized savings. It also anticipates additional substantial savings in the second half. Consequently, the company will incur a one-time restructuring charge of around £12 million in H1 FY24.

Is Hays a Buy or Sell?

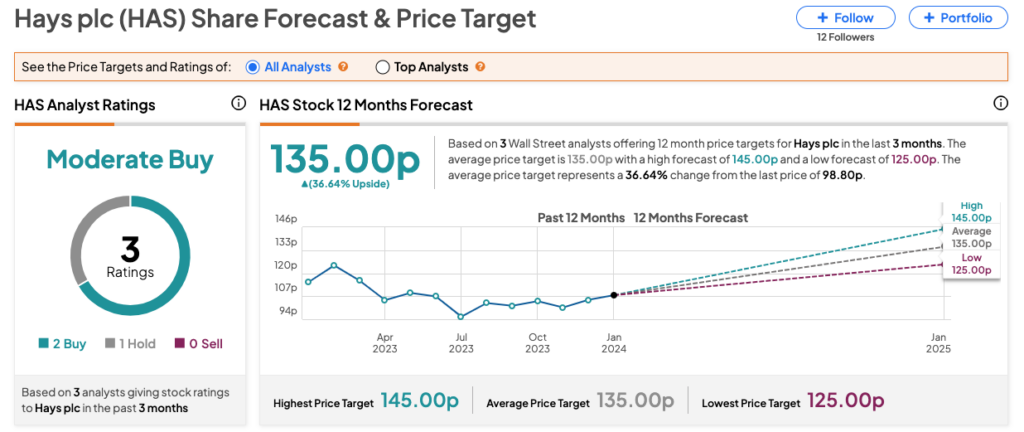

HAS stock has received a Moderate Buy rating on TipRanks, backed by two Buys and one Hold recommendation. The Hays share price forecast is 135p, which is 36.6% higher than the current trading level.