2022 was all about war, inflation, interest rate hikes, and volatile markets. There is no denying that the recessionary concerns are real and here to stay for a bit longer. This puts an important question in front of investors: where should they invest their money?

Even though we cannot fully protect our portfolio from recession, some sectors will survive better during these times. Consumer staples like groceries, food items, and personal care items’ demand remain stable, and such companies benefit from stable top-line growth. However, the higher material costs remain a challenge.

The Australian companies Woolworths Group Ltd. (AU:WOW) and Wesfarmers Limited (AU:WES) are apt for this situation. These companies also check the box for a decent dividend income.

Let’s have a closer look at them.

Woolworths Group Ltd.

Woolworths Group is a trusted name in Australia’s retail space, providing groceries, health products, pet supplies, and more to millions of customers.

The share price didn’t have a smooth year and has been trading down by 10%. However, its long-term gain of 68% in the last five years suggests the fundamentals are intact.

The company’s last few quarters’ performances were impacted by COVID, but now the company is progressing towards its normal operations. Sales in 2022 totaled AU$60.8 billion, up 9.2% from the previous year. The group’s net profit after tax was marginally up by 0.7% to AU$1.5 billion.

Inflation is still a concern for the company, as the average Australian food price increased by 7.3% in the first quarter of 2023, causing a shift in spending habits.

Lisa Deng from Goldman Sachs believes there is a clear growth track for the company until 2025. She expects a growth of 3% in sales and 9% in profit after tax over the next 2-3 years.

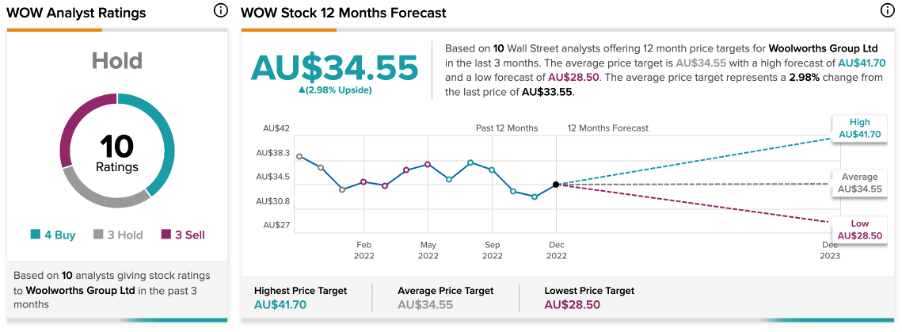

Woolworths Share Price Forecast

According to TipRanks’ analyst consensus, Woolworths’ stock has a Hold rating.

The target price is €34.55, which is 3% higher than the current price level.

Wesfarmers Limited

Wesfarmers is a vast company with many businesses under its umbrella. Based in Australia, the company deals in retail, home décor, health, industrial products, and more. The company has some strong and quality businesses in its portfolio, including even market leaders like Bunnings, Kmart, and Officeworks.

In the last year, the company’s share price is down by 20%, mainly due to commodity price volatility. But the analysts treat this as a good buying opportunity, as despite inflationary pressures, the Australians haven’t slashed their spending.

In 2022, the company’s revenues will be 8.5% higher at AU$36.8 billion. But, the net profit was down by 2.9% to AU$2.3 billion. However, the net profit was up by 13.1% in the second half of 2022, as the COVID restrictions were fully eased and the trading volumes improved. The company is already seeing growth in numbers in the first few weeks of its fiscal year 2023, especially at Bunnings, Kmart, and Officeworks.

With the second-half performance in mind, the company decided to announce a final dividend of AU$1.0 per share. The total for the year is AU$1.8 per share, up by 1.1% from 2021.

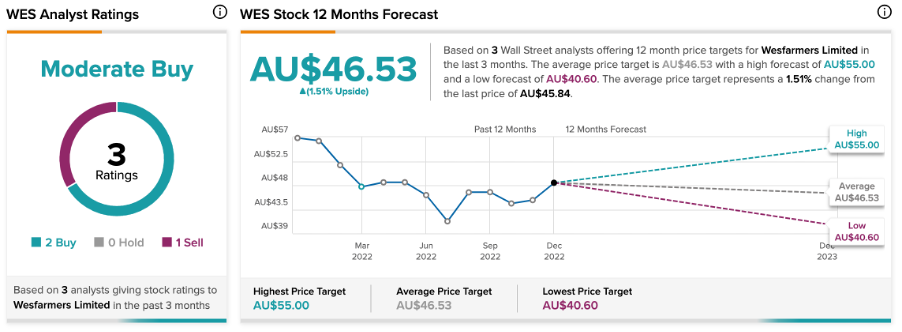

Is WES a Good Stock to Buy?

According to TipRanks’ rating consensus, Wesfarmers’ stock has a Moderate Buy rating.

The target price is AU$46.53, which represents a change of 1.5% on the current price level.

Conclusion

In an uncertain environment with the danger of an upcoming recession, investors need stocks they can hold onto for a very long time, like Woolworths and Wesfarmers. The passive income just makes buying them more attractive.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.