U.K.-based Smart Metering Systems (GB:SMS) has agreed to a takeover by the U.S.-listed private equity fund KKR (NYSE:KKR). SMS shares will be delisted after the takeover. The all-cash deal values SMS at £1.3 billion. KKR is offering 955 pence per share to SMS shareholders, representing a 40.4% premium to the stock’s Wednesday closing price. SMS’ board of directors has unanimously agreed to the takeover and urged shareholders to approve the same in the vote. SMS stock soared 41% on the news on December 7.

Rationale Behind the Deal

Smart Metering Systems is listed on AIM, a junior market for small and mid-sized companies. The company is an energy infrastructure provider that connects, owns, and maintains metering systems and a database of energy companies. KKR believes that through the acquisition, SMS will be able to unlock its full potential and transform into a “fully integrated, end-to-end energy infrastructure company.”

KKR will take SMS private by forming a new company owned by funds advised by KKR and its affiliates. The new company will provide the necessary capital to bolster its growth. SMS CEO Tim Mortlock views the deal as a significant win for shareholders as they can immediately realize the value of their investment.

Is Smart Metering Systems a Buy or Sell?

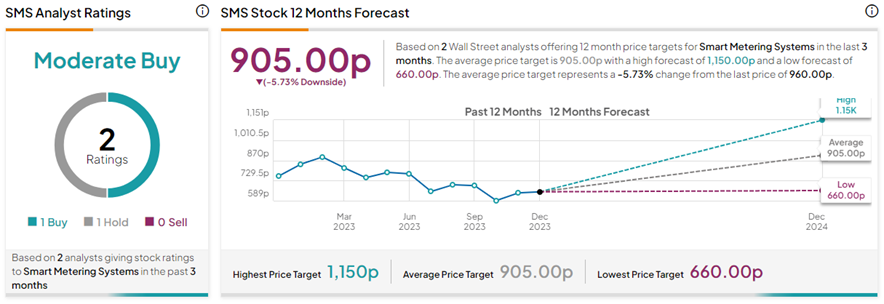

With one Buy versus one Hold rating on TipRanks, SMS stock has a Moderate Buy consensus rating. These ratings were given before the takeover news was announced and analysts could change their views on the stock. The Smart Metering Systems share price target of 905.00p implies 5.7% downside potential from current levels. Year-to-date, SMS shares have gained 26.7%.