SGX-listed companies Singapore Telecommunications Ltd., or Singtel (SG:Z74), and Genting Singapore Ltd. (SG:G13) are popular dividend stocks among investors. These stocks present appealing options for investors aiming to supplement their portfolios with additional income.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

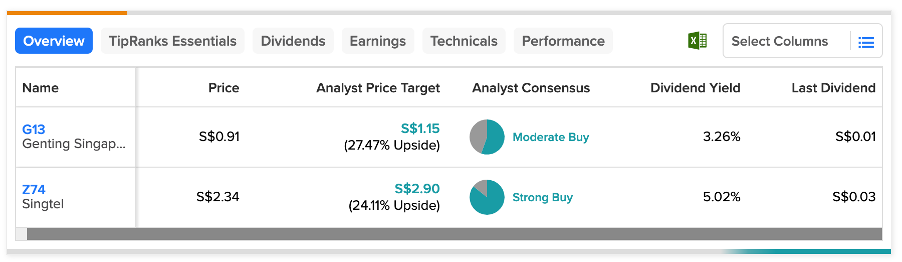

According to analysts, these shares have received Buy ratings and also offer more than 20% growth potential.

Let’s take a look at these companies in detail.

What is the Dividend for Singtel in 2023?

Singtel is a leading telecommunications service provider in Singapore. It provides a diverse range of services like fixed, mobile, internet, data, TV, etc. to its customers.

For the fiscal year 2023, the company paid a total dividend worth S$1.63 billion. This was equivalent to a dividend of S$0.099 per share, which was above the previous year’s payment of S$0.93. This translates to a payout ratio of 80% of the underlying net profit for fiscal year 2023. In 2023, the company additionally declared a special dividend of S$0.025. With a dividend yield of 5.02%, the company remains committed to upholding regular dividends within a scope of 60% to 80% of the underlying net profit, as reiterated in its 2023 earnings.

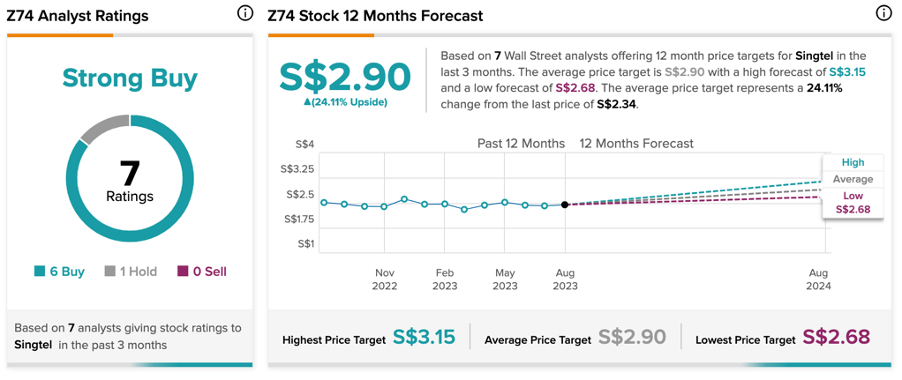

According to TipRanks’ rating consensus, Z74 stock has a Strong Buy rating backed by six Buy and one Hold recommendations. Singtel’s share price target is S$2.90, which is 24.1% higher than the current price level.

What is the Dividend for Genting Singapore in 2023?

Genting Singapore Limited operates as an investment holding company involved in the development and management of resorts and casinos. The company owns Resorts World Sentosa (RWS), which remains a famous attraction among tourists worldwide.

In H1 2023, the company posted a 63% jump in its revenues of SG$1.08 billion. The net profit increased to S$276.7 million, showing a huge growth of 228% over the first half of 2022. After posting strong first-half earnings for 2023, it raised its interim dividend by 50%, moving from S$0.01 to S$0.015. The company’s dividend yield is 3.26%, which is above the industry average of 2.9%.

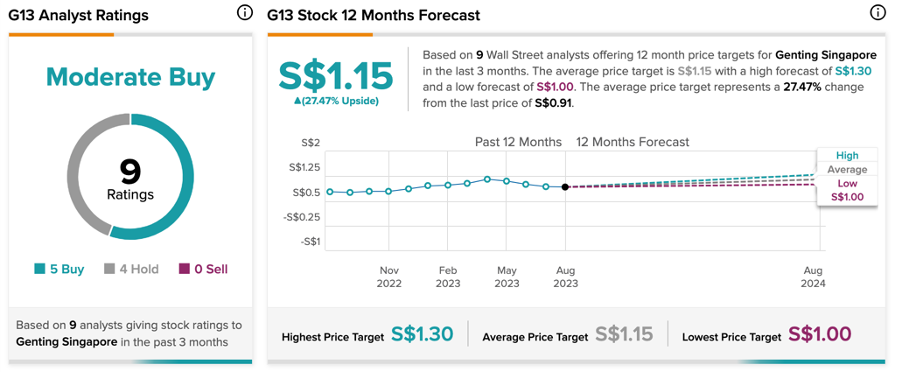

Analysts expect the recovery in Chinese travel to persist throughout the rest of 2023, contributing to Genting Singapore’s earnings in the upcoming quarters. In terms of share price growth, analysts have assigned Moderate Buy rating on the G13 stock based on five Buy versus four Hold recommendations. On TipRanks, Genting Singapore’s share price target is S$1.15, implying an upside of 27.5%.

Conclusion

For investors in search of consistent dividend income, Genting Singapore and Singtel, both listed on the SGX, appear to be suitable options.