In major news on Singapore stocks, SGX-listed Seatrium Limited (SG:S51), formerly known as Sembcorp Marine, posted a loss of S$1.9 billion for the full year that ended on December 31, 2023. The losses were triggered by massive non-cash asset write-downs that more than offset solid revenue growth. Post-results, Seatrium shares traded down by 2.15% on Monday.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Seatrium was formed from the merger of Sembcorp Marine with Keppel Offshore & Marine in April 2023. The company specializes in providing comprehensive engineering solutions to the global offshore, marine, and energy sectors.

Insights from 2023 Results

Seatrium’s 2023 revenue of S$7.3 billion marked a more than three-fold increase over the S$1.9 billion reported last year. The group’s net order book now totals S$16.2 billion, reflecting new orders worth S$4.5 billion in 2023 and to date in 2024.

The company’s EBITDA improved to S$236 million from a negative value of S$7 million in 2022. However, the net loss for the year widened significantly to S$1.9 billion from S$261 million in the prior year due to S$2 billion worth of non-cash write-downs, provisions for contracts, legal and corporate claims, and merger-related expenses.

Furthermore, Seatrium announced a settlement with Brazilian authorities over corruption allegations linked to Operation Car Wash. The company has agreed to pay S$182.4 million in settlement, putting an end to this outstanding legal matter. The settlement also paves the way for the company to participate in tenders and other bidding projects in Brazil.

Share Consolidation

Along with the results, Seatrium unveiled a plan for a 20:1 share consolidation to boost investor interest in its listed shares. The consolidation, contingent upon shareholders’ approval, aims to decrease price volatility and deter speculation.

After the share consolidation, there will be 3.41 billion total outstanding shares, with an unchanged paid-up share capital of S$8.58 billion.

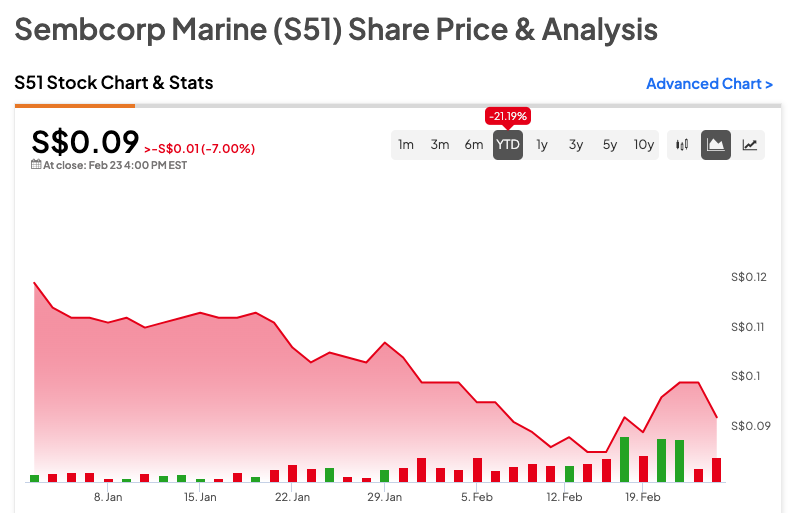

Year-to-date, the Seatrium share price has lost 24.17% in trading.