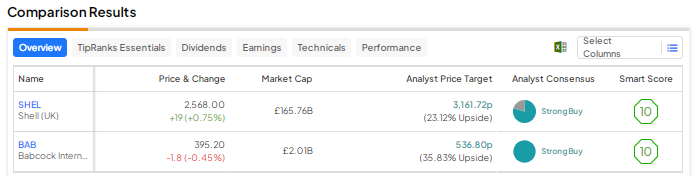

The UK stock market’s performance in 2023 trailed that of its European and U.S. counterparts due to a weak economic backdrop and political chaos. The FTSE 100 and FTSE 250 rose 3.8% and 4.4%, respectively, in 2023, significantly lagging the 24.2% rise in the S&P 500 Index (SPX). Potential interest rate cuts by the Bank of England are expected to drive the UK stock market higher in 2024. However, continued macro uncertainty could weigh on investor sentiment. Amid this backdrop, let us look at two U.K. stocks – Shell (GB:SHEL) and Babcock International (GB:BAB) that have earned a Strong Buy consensus rating from analysts.

TipRanks’ Strong Buy rating serves as a guide for selecting stocks that have the potential for long-term returns. Additionally, TipRanks provides a wide range of tools, including Stock Comparison and Top Dividend Shares, to assist in the selection of stocks across various markets.

Let’s take a look at these two stocks in detail.

Shell (GB:SHEL)

First up is oil and gas giant Shell. After delivering stellar profits in 2022, the company’s earnings declined on a year-over-year basis in 2023, as oil prices have retreated from the elevated levels seen last year.

Last month, the company reported a 34% year-over-year decline in its Q3 2023 adjusted earnings to $6.2 billion. However, adjusted earnings increased 23% compared to the second quarter of 2023, driven by increased refining margins, higher realized oil prices, higher LNG trading results, and a rise in upstream production, partially offset by lower integrated gas volumes.

Shell distributed $4.9 billion to shareholders in the third quarter through share repurchases worth $2.7 billion and dividends of $2.2 billion. Shell offers a dividend yield of 3.7%. Moreover, the company announced a new share buyback plan that is expected to be completed by the Q4 2023 results announcement.

Looking ahead, Shell continues to direct a substantial portion of its investments toward fossil fuels, while also working on reducing carbon emissions. Shell intends to invest $40 billion in oil and gas production between 2023 and 2035, compared with an investment of $10 billion to $15 billion in low-carbon products.

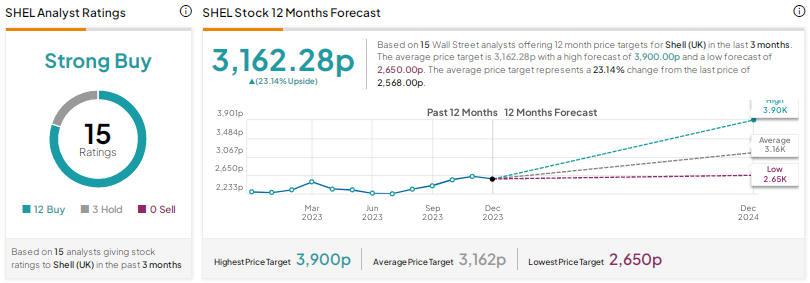

Is Shell a Good Stock to Buy?

Shell earns a Strong Buy consensus rating based on 12 Buys and three Holds. The average Shell share price target of 3,162.28p implies 23.1% upside potential. Shares rose about 15% in 2023.

Babcock International (GB:BAB)

Babcock is a defence company focused on its operations in the UK, Australasia, Canada, France, and South Africa. Babcock shares rallied 40% in 2022, thanks to the solid demand for defence products due to the Russia-Ukraine war and the conflict in the Middle East.

Last month, the company reported a 1.5% rise in revenue to £2.18 billion for the first half of FY24 (ended September 30, 2023). The underlying operating profit grew 27% to £154.4 million. Interestingly, the company reinstated its dividends after a four-year halt. The interim dividend of 1.7p per share is payable on January 19, 2024.

Given a favorable demand environment and a contract backlog of £9.6 billion, the company is optimistic about the growth ahead.

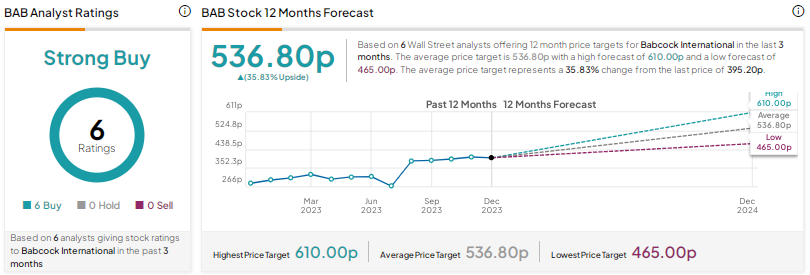

What is the Share Price Forecast for Babcock?

With six unanimous Buys, Babcock International scores a Strong Buy consensus rating. The average Babcock International share price target of 536.80p implies nearly 36% upside potential.