Maybank Securities maintains its bullish stance on the SGX-listed Dyna-Mac Holdings Limited (SG:NO4) and views the shares as an attractive buying opportunity. According to The Edge Singapore, analyst Jarick Seet from Maybank stated that the recent downfall in Dyna-Mac’s shares is “overdone,” creating a good entry point for investors. The shares have declined by almost 30% in the last three months.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Dyna-Mac is one of the leading companies that design and construct modules for the hydrocarbons industry.

Maybank Analyst’s Bullish Stance

Seet holds a bullish view on the company’s future, citing its robust order book, which stood at S$542.7 million as of June 2023. Notably, in October, the company secured additional orders, pushing the total order book value to SG$630.7 million.

Seet anticipates a surge in available projects next year, forecasting an additional S$200 million to S$350 million worth of contracts in the first half of FY24. The company is also optimistic about the times ahead and highlighted a high volume of inquiries for projects in both Singapore and China, which enhances top-line visibility for fiscal years 2025 and 2026.

Seet sees the upcoming FY2023 earnings report as a “positive catalyst for the stock.” He expects an earnings growth of 54% over the S$21 million reported in FY2022. Seet has assigned a Buy rating to Dyna Mac stock with a price target of SG$0.52, which implies an upside of over 90% in the shares.

What is the Price Target for Dyna Mac?

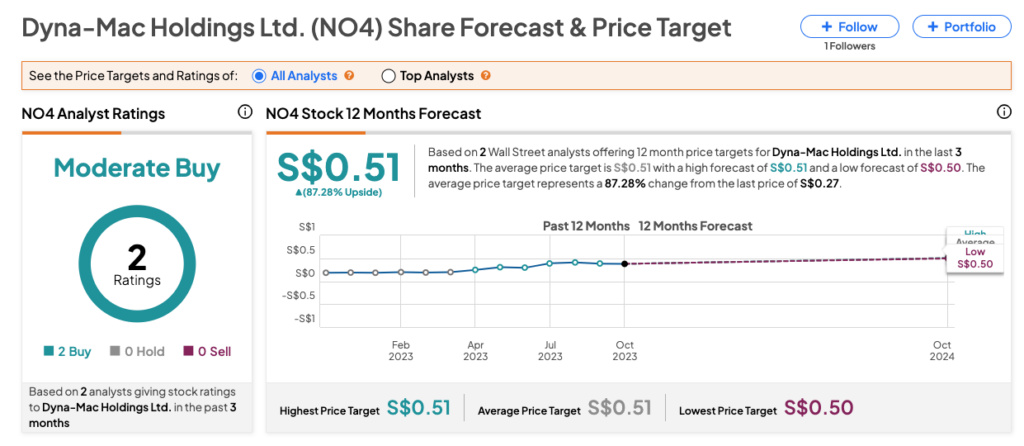

As per the consensus rating on TipRanks, NO4 stock has received a Moderate Buy rating, supported by two Buy recommendations. The Dyna-Mac share price target is S$0.51, which is 87.3% above the current level.