The SGX-listed Sembcorp Industries Limited’s (SG:U96) share price has registered a remarkable year with a gain of 54.3% in 2023. Sembcorp is a Singapore-based conglomerate focused on the energy and urban development sectors. It is known for its huge scale, brand reputation, and solid track record of earnings. Looking ahead, analysts remain bullish on the stock with a Strong Buy rating, predicting further upside in the share price.

Renewables Expansion Takes Center Stage

Sembcorp is dedicated to transitioning its portfolio towards a greener future, aspiring to emerge as a prominent provider of sustainable solutions. The company’s significant expansion in the renewables segment paves the way for its future growth.

In the Investor Day held in November, the company unveiled its capital expenditure (capex) strategy, amounting to S$14 billion spanning from 2024 to 2028. Most of these funds will be directed towards renewable energy assets, aiming to elevate the gross installed capacity from the current 8.7 GW to 25 GW. Sembcorp’s recent acquisitions in India and China are expected to be a major contributor to its renewable capacity expansion.

The significant investment is set to be funded through multiple channels, including operating cash flow from its existing energy assets and corporate debt. Importantly, the company is not planning to raise funds via equity, underscoring its robust financial position.

First Half FY23 Snapshot

In the first half of FY23, the company delivered a mixed performance. Revenues declined by 6% to S$3.7 billion. However, EBITDA jumped by 59% to S$993 million. The company also increased its interim dividend to S$0.05 per share, up from S$0.04 paid for the first half of 2022.

What is the Price Prediction for Sembcorp Stock?

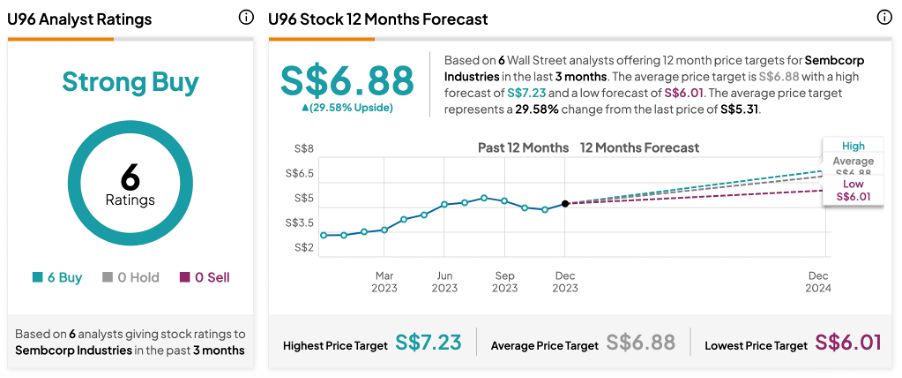

According to TipRanks consensus, U96 stock has received a Strong Buy rating, backed by Buy recommendations from all the six analysts covering the stock. The Sembcorp Industries share price target is set at S$6.88, which is about 30% above the current trading level.