The SGX-listed Sembcorp Industries Limited (SG:U96) on Monday announced the expansion of its wind assets portfolio with investments in India and China. The company has signed two agreements to acquire a combined total of 428 MW (megawatts) of wind assets for a total consideration of S$200 million. With these assets, Sembcorp has secured a total of 673 MW of renewable capacity since the announcement of its targets earlier this month. The company is aiming to achieve 25 GW (gigawatts) of gross installed renewable capacity by 2028.

The share price ended the day at a loss of 0.2% on Monday. Extending this downward trend, the stock is currently trading down by 1.17% at the time of writing today. Year-to-date, the stock has delivered a solid return of over 50% in trading.

Sembcorp Industries positions itself as a sustainable solutions company with a primary focus on energy and urban development. The company’s goal is to shift its portfolio towards a more environmentally friendly future, aspiring to solidify its position as a leading provider of sustainable solutions.

The Deal Particulars

The agreements include the purchase of 228 MW of operational wind power assets from Leap Green Energy Pvt. Ltd., which is an independent power company in Tamil Nadu, India. The company signed the deal via its fully-owned subsidiary, Green Infra Wind Energy Limited (GIWEL), for S$70 million.

In another agreement, Sembcorp Energy (Shanghai) Holding, a fully-owned entity, has signed a deal with Envision Energy to purchase the entire share capital of Qinzhou Yuanneng Wind Power for S$130 million. Qinzhou Yuanneng currently possesses 200 MW of operational wind assets in Guangxi, China.

The acquisitions will be financed through a combination of internal cash resources and outside funding. The deals are anticipated to close by the first half of 2024, contingent on meeting relevant conditions and regulatory approvals.

Is Sembcorp Industries a Good Buy?

Analysts don’t see any material impact of these deals on the company’s earnings per share in its full-year results for the year ending December 31, 2023. The company will announce the results on February 23, 2024.

Overall, analysts maintain a positive outlook on the stock, fuelled by the company’s substantial expansion within the renewables segment, indicating a key driver for future success.

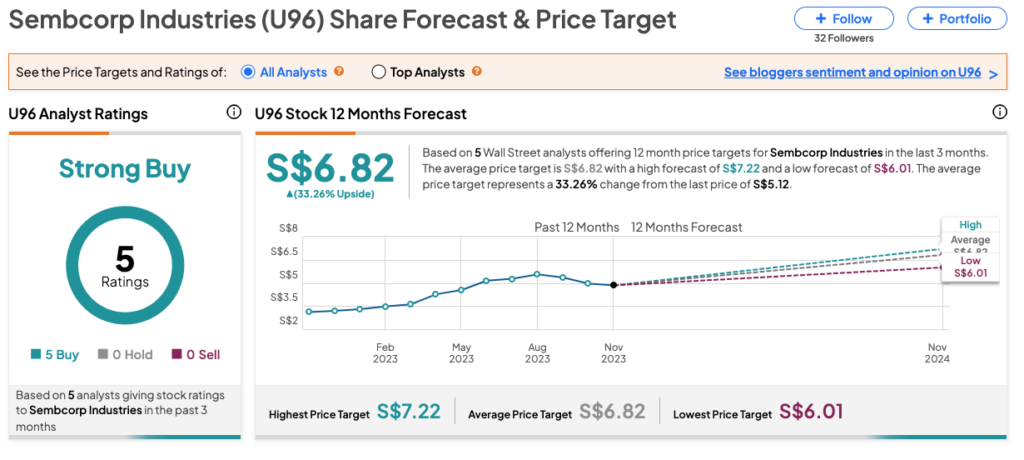

According to TipRanks consensus, U96 stock has received a Strong Buy rating, backed by all Buy ratings from five analysts. The Sembcorp Industries share price target is set at S$6.82, reflecting a 33.3% increase from the current trading level.