DAX 40-listed SAP SE (DE:SAP) announced a major restructuring plan yesterday, including a strategic shift toward artificial intelligence (AI), during its Q4 results. Further, the company is slashing 8,000 jobs or 7% of its global workforce. SAP’s Cloud segment remained the highlight of the discussions in the earnings update for the year ending December 31, 2023. SAP shares are up 7.1% in Wednesday’s early morning trading.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

SAP SE is a German multinational software company. It develops enterprise software for managing business operations and customer relations. SAP shares have gained over 40% in the past year.

SAP’s FY23 Results and Restructuring Plans

SAP’s total revenue rose 6% annually to €31.21 billion, including a 20% jump in Cloud revenue. The current Cloud backlog stands at €13.75 billion, up 25% compared to the year-ago period. Importantly, Cloud revenue contributed nearly 44% of the group’s total revenue, marking a drastic shift toward the lucrative segment.

For Fiscal 2024, SAP forecasts Cloud revenue to grow in the 24% to 27% range and operating profits to increase between 17% and 21%. Also, in 2025, SAP projects an operating profit of €10 billion, which is €2 billion lower than its prior guidance owing to share-based compensation.

SAP expects that generative AI will significantly change its business prospects. It announced a $1 billion investment in AI-backed technology startups through its enterprise capital firm Sapphire Ventures.

SAP CEO Christian Klein said that the company exceeded its expectations for Fiscal 2023 on all important metrics. Looking ahead, SAP is on track to transform into an AI-focused company, keeping in line with the industry dynamics and the latest AI buzz, Klein added. Recently, SAP even rearranged its board of directors to become more cloud-centric.

Meanwhile, talking about the layoffs, Klein said that most of the roles will be cut via voluntary leave programs and internal “re-skilling measures.” Klein also noted that SAP will exit 2024 with nearly the same headcount levels. The restructuring plan is expected to cost €2 billion to the company, with most of the expenses borne in the first half of 2024. Moreover, the efficiency improvements from the plan are expected to contribute over €500 million to operating profits in 2025.

What is the Future of SAP Stock?

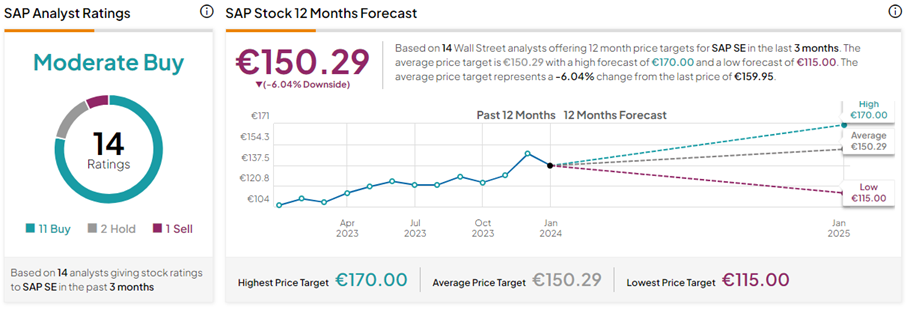

Following the restructuring news, UBS analyst Michael Briest and Baader Bank analyst Knut Woller reiterated their Buy ratings on SAP stock. Briest has a price target of €168, while Woller has a relatively lower price target of €140.

Overall, SAP stock has a Moderate Buy consensus rating based on 11 Buys, two Holds, and one Sell rating. The SAP SE share price forecast of €150.29 implies 6% downside potential from current levels. The consensus price forecast is below the current share price since the stock price is up 7% today. Some analysts could also revisit their stance on the stock following the news.