French car maker Renault SA (FR:RNO) has abandoned its plans to list its electric vehicle (EV) unit Ampere this year. Sluggish EV demand and poor investor appetite forced Renault to reconsider its IPO (initial public offering) plans. Renault said that it can generate enough cash to self-fund the unit until it reaches a break-even point in 2025. RNO shares sank as much as 2.3% in early trade yesterday following the news.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Renault broadly operates two automobile units – its traditional internal combustion engine (ICE) manufacturing unit, called Horse, and its EV unit, Ampere. RNO shares have lost over 6% in the past year owing to heated competition in the auto sector and macro pressures.

Here’s Why Renault is Not Listing Ampere

Renault is concerned that the listing of Ampere might not fetch the desired momentum and money as envisaged by the management. Last year, group CEO Luca de Meo said that he expects to raise €10 billion from Ampere’s IPO. Global capital markets have been dull in 2023, and the signs of any recovery this year remain hazy.

Importantly, Renault highlighted that EV demand in Europe has been sluggish. Competition from Chinese car makers and high interest rates continue to daunt the market. Considering the weak equity markets, macro headwinds, and the group’s solid cash flow position, Renault has decided to cancel Ampere’s IPO plans. Having said that, the CEO believes that the European EV industry has the potential to grow in the future and expects Ampere to play an important role in that.

Renault stated that its financial strength and ability to generate substantial cash flows to fund Ampere will be showcased when the company reports its Fiscal 2023 results in February.

Ampere’s IPO was much awaited by investors and Renault’s partners Nissan (DE:NISE) and Japanese carmaker Mitsubishi (OTCMKTS:MMTOF). Despite the setback in the IPO plans, both partners have confirmed that they will continue investing in Ampere.

Is Renault a Buy or Sell?

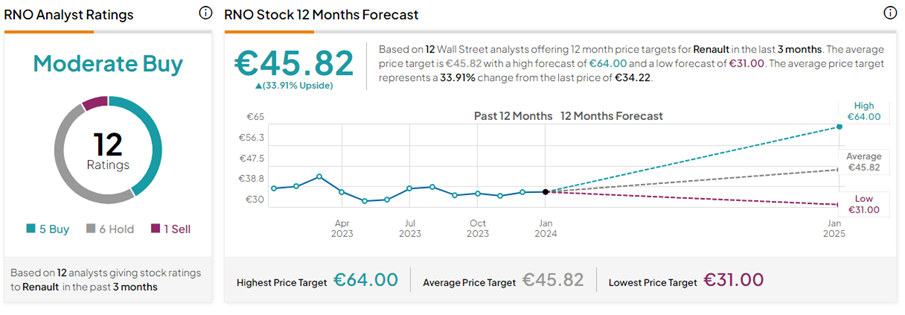

Following Renault’s decision to scrap Ampere’s IPO, Jefferies analyst Philippe Houchois reiterated a Buy rating on RNO stock with a price target of €53 (54.9% upside). The five-star analyst believes Renault’s surprise decision could prove beneficial for the investors, as it prevents immediate share dilution and streamlines the investment case.

In contrast, UBS analyst David Lesne reiterated a Sell rating on RNO stock with a price target of €31 (9.4% downside). Lesne is concerned that the growing competition from Chinese players could crush the European EV market.

Overall, RNO stock has a Moderate Buy consensus rating based on five Buys, six Holds, and one Sell rating. The Renault SA share price forecast of €45.82 implies 33.9% upside potential from current levels.