The share price of the British food company Premier Foods PLC (GB:PFD) gained around 4% today after the company announced the acquisition of FUEL10K for £34 million. By acquiring FUEL10K, a breakfast brand preferred by the younger generation for its food products, Premier Foods has strategically strengthened its presence in this segment. FUEL10K has achieved double-digit revenue growth in the past three years and is expected to significantly enhance Premier’s appeal to a younger audience while driving increased profitability.”

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s stock was trading up by 4% on Monday at the time of writing. This came as a relief to investors, considering the decline of 10% over the last three months.

Premier Foods is a leading food manufacturing company in the UK, known for its brands like Marvel, Ambrosia, OXO, Mr Kipling, and many more. The company caters to a diverse range of customers, including wholesale, retail, food service operators, etc.

The Acquisition Rationale

The deal value of £34 million includes an initial cash payment of £29.6 million, which was paid via the company’s reserves. The remaining deferred payment of £4 million is contingent upon meeting growth targets and is slated for 2026-27. The total purchase price is 1.6x the expected revenues of the company for FY24 ending on March 31, 2024.

Premier Foods ventured into the breakfast category in 2022 by introducing Ambrosia ready-to-eat porridge pots, which generated solid sales for the company. The addition of FUEL10K serves as a fantastic platform for further enhancing the company’s breakfast portfolio with the brand’s protein-enriched products and appealing to a younger demographic.

On the other hand, FUEL10K is excited to be joining hands with one of the leading stable brands in the market.

Is Premier Foods a Good Share to Buy?

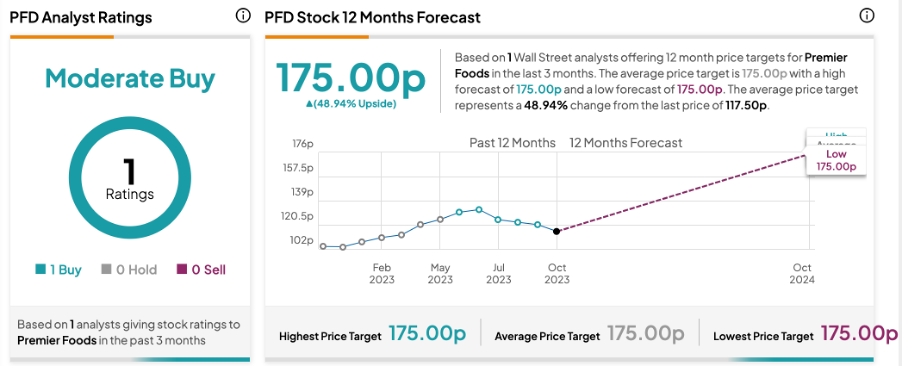

On TipRanks, PFD stock has received a Moderate Buy rating based on one Buy recommendation from analyst Andrew Wade from Jefferies. After the deal announcement today, Wade reiterated his Buy rating on the stock, predicting an upside of 50% in the share price.

The Premier Foods share price target is 175p, which implies a huge upside potential of 50% from the current trading levels.