SGX-listed Oversea-Chinese Banking Corp. Ltd., or OCBC Bank (SG:O39), is among the most popular dividend stocks in the Singapore market. OCBC continues to hold strong appeal for income investors due to its impressive dividend yield of 6.27%. This figure stands significantly above the sector’s average of 2.1%. The bank also delivered upbeat first-half earnings for FY23, with higher interest rates benefiting the bottom-line performance. This came as good news for shareholders who witnessed a more than 40% hike in their interim dividend payment.

Looking ahead, analysts anticipate robust performance from the bank, which should further fortify the dividend payments in the future. OCBC stock has received a Moderate Buy rating on TipRanks.

OCBC Bank is among the oldest and largest financial institutions in Singapore. The bank provides a complete range of banking, investment, insurance, and other services.

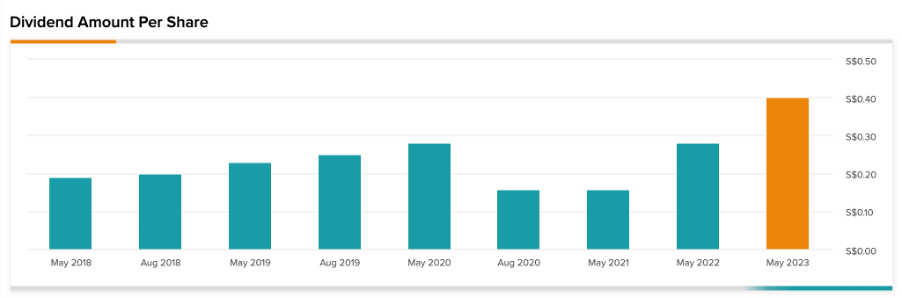

OCBC Share Dividend 2023

During its half-yearly results, the bank announced an interim dividend of S$0.40 per share, a substantial 43% increase from the previous S$0.28. This decision aligns with a payout ratio of 50%, calculated based on the group’s net profit for the first half. The interim dividend was paid on August 25 to the shareholders registered until August 14, 2023.

The bank achieved a record profit of S$1.71 billion in Q2 2023. The substantial increase in net interest income was the primary catalyst behind these results. In Q2, the net interest margin rose to 2.26%, a notable improvement from the 1.71% seen the previous year. The net interest margin is anticipated to remain above 2.2% for the entirety of 2023.

In July, the bank commenced a significant rebranding initiative featuring a new logo and tagline. Its objective is to generate an additional S$3 billion in revenue over the forthcoming three years. This is expected to result in enhanced revenue and profits for the bank, thereby elevating the prospects of a higher year-end dividend for FY23 and subsequent years.

What is the Target Price for OCBC Share?

According to the rating consensus on TipRanks, O39 stock received a Moderate Buy rating, supported by 10 analysts’ recommendations. The OCBC share price stands at S$14.34, representing an 11.2% increase from the current price level.

YTD, the stock has experienced a gain of over 12%.

Conclusion

Dividends represent a valuable form of passive income. The SGX-listed OCBC bank offers this opportunity by consistently delivering dividend payments underpinned by strong operational performance.