Britain’s energy giant Harbour Energy (GB:HBR) has agreed to buy all the non-Russian upstream assets of German oil and gas company Wintershall Dea for US$11.2 billion. The cash and stock deal involves buying shares from Wintershall Dea’s existing majority shareholders, BASF SE (DE:BAS) and LetterOne. The deal is expected to close in the fourth quarter of 2024, subject to regulatory conditions and shareholder approval. HBR shares rallied over 23% on the news on December 21.

Harbour Energy is an FTSE 250-listed oil and gas company. HBR boasts of being the largest London-listed independent oil and gas company with a leading position in the U.K. as well as interests in Indonesia, Vietnam, Mexico, and Norway. The company is seeking to expand its footprint beyond the U.K. after the government imposed a windfall tax on the energy sector in response to the stellar profits resulting from the record high oil prices in 2022.

However, oil prices have retreated from the high levels seen last year. In the six months ending June 30, 2023, HBR recorded a post-tax loss of US$8 million due to the higher U.K. tax rate and one-time charges. Year-to-date, HBR shares have gained 4.4%.

Further Details About the Deal

Harbour Energy is buying Wintershall Dea’s upstream assets in Norway, Germany, Denmark, Argentina, Mexico, Egypt, Libya, and Algeria as well as its carbon-dioxide capture and storage licenses in Europe. The deal excludes any assets from the latter’s Russian operations. The acquisition will make Harbour Energy one of the world’s largest independent oil and gas producers. The deal is expected to be immediately accretive to HBR’s free cash flow.

Following the deal’s completion, the German chemical company BASF’s 72.7% stake in Wintershall Dea will be converted into 46.5% of HBR shares. Meanwhile, LetterOne, which owns 27.3% of Wintershall Dea, will own 251.5 million non‐voting, non‐listed convertible ordinary shares with preferential rights in HBR.

Here’s How the Deal Will Impact HBR’s Financials

The combined company will have a production of over 500 barrels of oil equivalent per day (boepd), primarily from Norway and Argentina. On a proforma basis, the merged company would have earned US$5.1 billion and EBITDAX (earnings before interest, tax, depreciation, amortization, and exploration expense) of US$3.7 billion in the first six months of 2023.

Further, post-completion of the merger, Harbour expects its credit rating to improve to investment grade. Harbour will take over US$4.9 billion of existing Wintershall Dea Bonds and pay an extra US$2.15 billion as cash consideration from Wintershall Dea’s cash flows.

Is Harbour Energy a Good Buy?

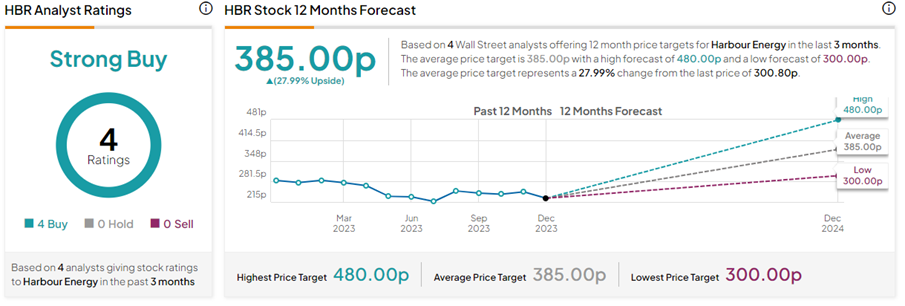

With four unanimous Buy ratings, HBR stock has a Strong Buy consensus rating on TipRanks. All these ratings were given before the Wintershall Dea announcement and are subject to change. The Harbour Energy share price target of 385.00p implies a nearly 28% upside potential from current levels.