Among major Hong Kong stocks, Zijin Mining Group Co. Ltd. (HK:2899) shares are continuing their upward momentum, driven by record gold prices. Zijin shares reached an all-time high of HK$16.8 on Monday, as gold prices continued to rally due to robust demand from Asian Central banks. The stock has surged by nearly 10% in the past five days, marking a 30% year-to-date gain.

Zijin is a multinational mining conglomerate focused on the exploration and development of gold, copper, and various other mineral resources.

Record-Breaking Gold Prices

Over the past six months, gold prices have surged by approximately 25%, rising from $1,845.50 per ounce to $2,298.50 as of April 5th. The growth is primarily due to geopolitical tensions and an uncertain economic outlook. Gold is widely regarded as a safe-haven asset during times of instability. Additionally, central banks are preparing to transition to lower interest rates, which bodes well for precious metals such as gold.

Experts believe Gold prices will continue to soar amid ongoing conflicts, forthcoming U.S. elections, and the prevailing interest rate landscape.

Zijin’s Strong Production and Promising Outlook

In 2023, Zijin mined 68kt (thousands of tonnes) of gold, marking a 20% increase over the previous year. Since 2020, the company has achieved a compound annual growth rate exceeding 15% in output, cementing its leadership position in the industry.

Looking ahead, with a promising outlook for gold, Zijin is seizing this lucrative opportunity by intensifying its efforts to boost production capacity. With the Porgera Gold Mine in Papua New Guinea resuming production and the Rosebel Gold Mine in Suriname gearing up to increase output, Zijin is well-positioned for growth. The company aims to achieve a gold production target of 73.5 tonnes in 2024.

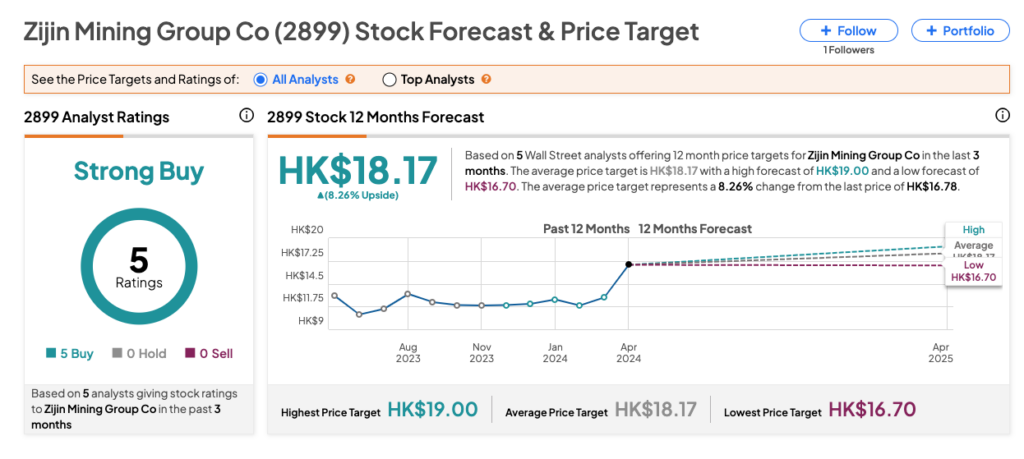

What is the Price Target for Zijin Mining Stock?

According to TipRanks’ rating consensus, 2899 stock has received a Strong Buy rating based on all five Buy recommendations. The Zijin share price target is HK$18.17, which is 8.26% higher than the current price level.