In major news on Hong Kong stocks, Country Garden Holdings Co. (HK:2007) announced the settlement of its onshore coupons before the end of a five-day grace period. This news came after the company failed to meet the payment deadline for these coupons last Thursday and reiterated its efforts to secure additional funds. The company cited reasons such as slower-than-expected sales recovery and difficulties in reallocating capital as the main reasons for the missed payments last week.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The coupons, amounting to ¥65.95 million ($9.1 million), are associated with two medium-term notes that were guaranteed by China Bond Insurance Co. and issued in May 2023.

Country Garden: From Triumph to Turmoil

Once a major player in China’s real estate landscape, Country Garden held the title of the largest private developer in the market. However, the company is facing mounting challenges amidst the ongoing crisis in China’s property market. In April 2024, trading of Country Garden’s shares was halted following its failure to publish its 2023 annual results.

The company had defaulted on nearly $15 billion of offshore bonds and loans and also delayed the payment of other onshore bonds. With defaults on offshore payments and the looming threat of a winding-up petition in Hong Kong, the company faces the possibility of asset liquidation.

State Guarantor Intervenes to Rescue

With the escalating debt crisis and increasing defaults among property developers, the Chinese government stepped in, instructing a state-owned company to assist developers grappling with a liquidity shortage. Consequently, China Bond Insurance began providing guarantees for onshore bond issuance to selected developers, beginning in August 2022.

Country Garden stated last week that China Bond Insurance Co. would step in on its behalf if it failed to make these payments.

What is the Price Target for Country Garden Stock?

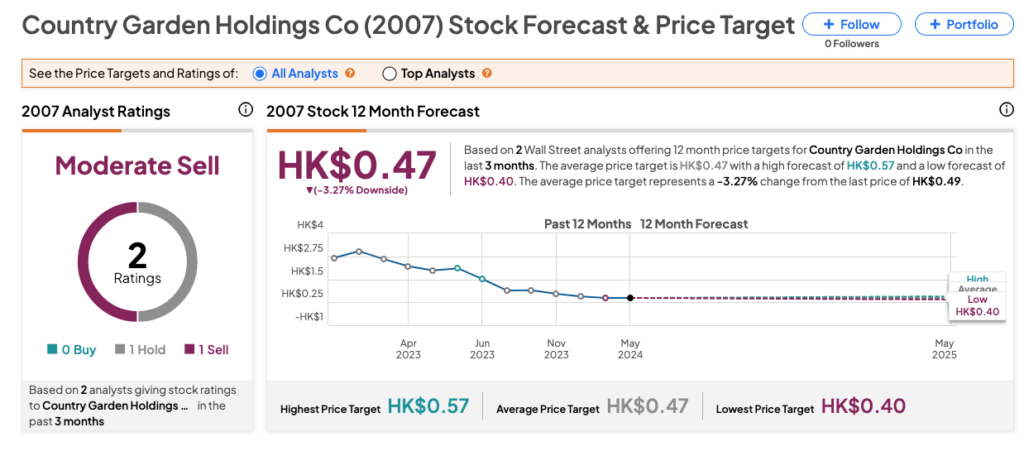

Country Garden shares have declined by over 70% in trading over the last 12 months, up to March 28, when trading was suspended.

2007 stock has a Moderate Sell rating on TipRanks based on one hold and one Sell recommendation. The Country Garden share price forecast is HK$0.47, which is 3.3% below the current trading level.