Hermes International (FR:RMS) shares rose nearly 5% on Friday after the French luxury goods company reported solid sales for the fourth quarter of 2023, defying the slowdown experienced by many of its peers. The company’s revenue increased 18% (at constant exchange rates) to €3.36 billion in Q4 2023, despite tough comparisons with the robust performance in America and Asia in the prior year’s comparable quarter.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

More on Hermes’ Impressive Results

Hermes, the maker of Birkin bags, witnessed double-digit revenue growth (at constant currency) across all regions in the fourth quarter. In particular, the company’s business in Asia generated revenue of €1.72 billion and was the largest contributor to the overall revenue.

Overall, Hermes generated €13.43 billion in revenue in 2023, reflecting a 21% growth at constant exchange rates. Net profit increased 28% to €4.31 billion, driven by higher revenue and a rise in operating margin to 42.1% from 40.5% in 2022. Further, the company’s operating cash flow increased 25% to €5.12 billion.

So far, the earnings season for the luxury industry has been mixed due to macro pressures and a slower-than-anticipated recovery in China, a key market. On Thursday, luxury goods player Kering (FR:KER) reported lower sales for Q4 2023 but managed to beat expectations.

Meanwhile, Hermes plans to propose a dividend of €15 per share for 2023, reflecting a 15% increase from €13 per share in 2022. The company also announced an “exceptional” dividend of €10 per share.

Is Hermes a Buy or Sell?

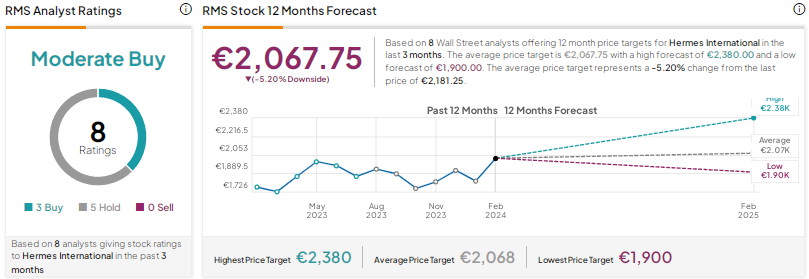

With three Buys and five Holds, RMS stock scores a Moderate Buy consensus rating. The Hermes International share price target of €2,067.75 implies a possible downside of 5.2%. Shares have advanced nearly 30% in the past year.