ASX-listed Whitehaven Coal Limited (AU:WHC) shares traded almost 4% higher today following the release of the company’s second-quarter production report. The company maintained its full-year ROM (run-of-mine) production and sales guidance for FY24. The Whitehaven share price rose to a high point of AU$8.30 during the day before closing at AU$8.11.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Whitehaven Coal specializes in the production of metallurgical and thermal coal, with a primary focus on exporting high-quality products.

Q2 Performance: Key Figures at a Glance

During Q2, ROM production reached 5.0Mt (million tonnes), experiencing a 6% decline compared to the previous quarter. However, the company still achieved a 21% quarter-on-quarter surge in total equity sales of produced coal, reaching 3.7Mt. The company achieved its sales at an average coal price of AU$216 per tonne, reflecting a 3.5% sequential decrease.

The numbers were driven by robust operational performances at Maules Creek and the Gunnedah Open Cut mines. On the flip side, ROM production at Narrabri was affected by geological headwinds.

Moving forward, the company expects strong performance from open-cut mines, with production numbers projected to reach the top end of the guidance range. This will offset the downgraded guidance from Narrabri, revised from 6.0–6.7 Mt to 5.1–5.7 Mt for the full year.

The company maintained its equity coal sales estimate in the range of 12.7 to 13.9Mt for the fiscal year ending June 30.

Is Whitehaven Coal a Good Share to Buy?

Post-update, Citi analyst Paul McTaggart reiterated his Buy rating on the stock, predicting an upside of 15.5%.

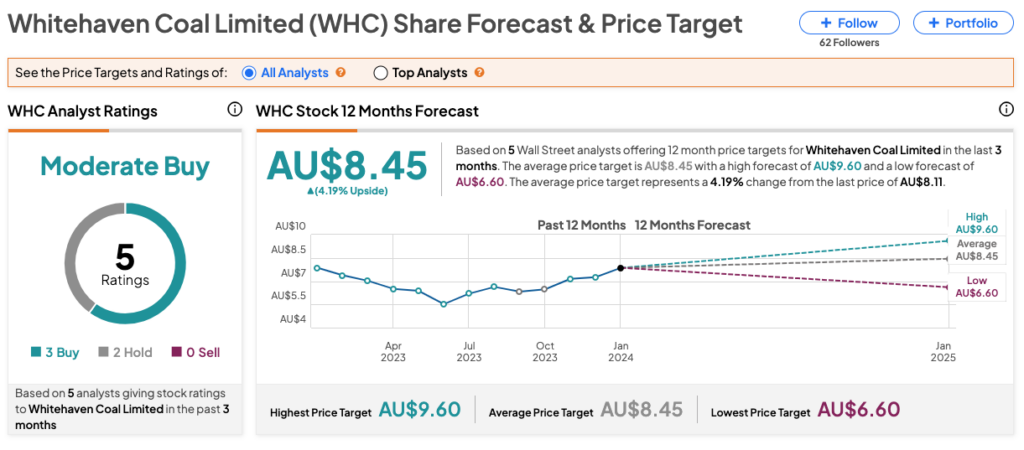

According to TipRanks’ analyst consensus, WHC stock has received a Moderate Buy rating based on three Buy and two Hold recommendations. The average share forecast is AU$8.45, which is around 4% above the current price level.