France’s luxury fashion house Kering SA (FR:KER) has expanded its U.S. base by acquiring a premium New York City (NYC) property. Kering has bought a multi-level luxury retail space in NYC’s premium Fifth Avenue for €885 million ($963 million).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

CAC 40-listed Kering SA is a multinational luxury goods company offering clothing, leather goods, watches, and jewelry. Kering boasts some ultra-premium luxury brands such as Gucci, Balenciaga, and Yves Saint Laurent. KER shares have lost over 33% in the past year.

Kering’s American Dream Gets Bigger

Kering has acquired a nearly 115,000-square-foot property on Fifth Avenue, which will host its luxury Houses. Kering follows a selective real estate strategy that involves buying and maintaining a luxury retail portfolio for its Houses in some of the most desirable locations around the world. Recently, Kering bought properties in Paris’ Avenue Montaigne and Rue de Castiglione.

The luxury retail industry has witnessed a downfall in the COVID-19 aftermath, marred by high inflation and increasing interest rates. Price-sensitive customers have chosen to shun luxury goods and focus on necessities and budget-friendly products.

However, fashion retailers have been on a buying spree recently, acquiring prestigious retail spaces across the globe to keep up with their iconic status. This is good news for the real estate sector as the resurgence could mean that the demand and the average asking rents could increase going ahead.

Kering is set to report its full-year Fiscal 2023 results on February 8, 2024. For Q4 FY23, analysts expect Kering to earn sales of €4.78 billion, much lower than the prior-year quarter’s sales of €5.28 billion.

Is Kering Stock a Good Buy?

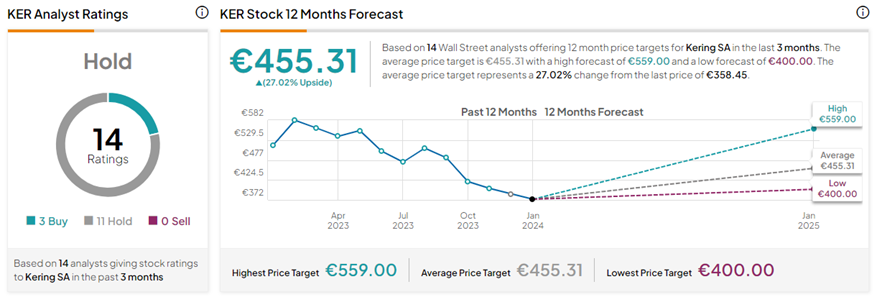

Recently, UBS analyst Zuzanna Pusz reiterated a Hold rating on KER stock with a price target of €413, implying 15.2% upside potential from current levels.

A majority of analysts on TipRanks echo the same sentiment for KER stock. With three Buys versus 11 Hold ratings, KER has a Hold consensus rating. The Kering SA share price target of €455.31 implies 27% upside potential from current levels.