Shares of British bakery chain Greggs plc (GB:GRG) are up 6.1% as of writing, following a favorable trading update for the fourth quarter. Overall, for Fiscal 2023, sales jumped 19.6% to £1.81 billion, while like-for-like sales grew 13.7%. This double-digit growth was attributed to longer opening hours at certain locations and online food order and delivery availability.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

FTSE 250-listed Greggs is principally engaged in manufacturing, distributing, and retailing bakery goods, sausages, sandwiches, and drinks. Its shops are located primarily in retail and industrial parks, motorway service stations, and travel hubs to meet the demands of busy customers. GRG shares have gained 1.8% in the past year.

Greggs’ Year-End Performance

In the fourth quarter, Greggs posted a 9.4% growth in like-for-like sales across its own managed shops. Greggs attributed the increase in Christmas sales to seasonal favourites.

Moreover, Greggs launched a delivery service with Uber Eats at 710 shops in 2023, alongside an existing service offered in collaboration with Just Eat.

The company’s full-year performance was driven by product price hikes, keeping in tandem with inflation. However, the company has said that going forward, it is not planning any immediate price hikes as inflation is easing. Also, it does not foresee any price cuts as increased wages are keeping the costs under pressure.

Meanwhile, Greggs maintained its full-year expectation of opening 140 to 160 net new stores in 2024. The company opened 145 net new stores in 2023. CEO Roisin Currie said that in 2024, Greggs aims to continue to invest in shops and increase supply chain capacity aided by a solid balance sheet. As of December 31, 2023, Greggs had £195 million in net cash.

Is Greggs a Good Stock to Buy?

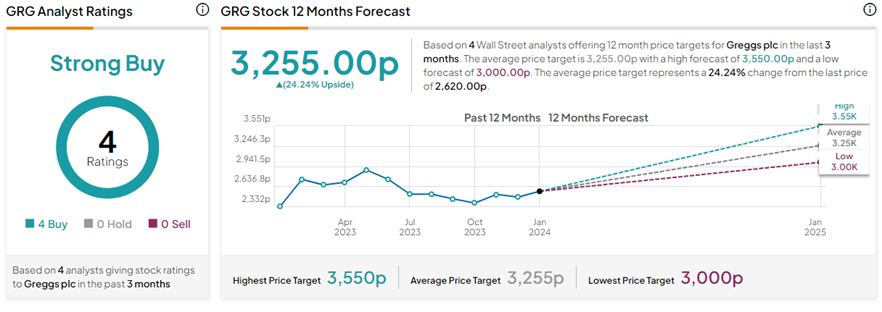

Following the company’s Q4 update, Jefferies analyst Andrew Wade reiterated a Buy rating on the stock with a price target of 3,450.00p (29.7% upside).

With four unanimous Buy ratings, GRG stock commands a Strong Buy consensus rating on TipRanks. The Greggs share price forecast of 3,255.00p implies 24.2% upside potential from current levels.